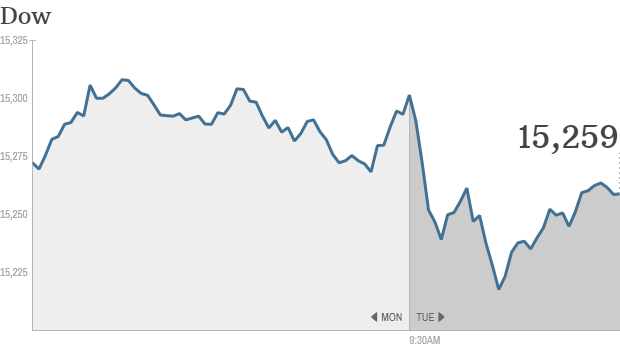

Click the chart for more stock market data.

NEW YORK (CNNMoney) Investors moved to the sidelines Tuesday as they waited for developments in Washington and digested a batch of earnings.The Dow Jones Industrial Average and S&P 500 fell slightly in early trading following four straight days of gains. The Nasdaq was flat.

Senate leaders have said they have made "tremendous progress" toward an agreement to end the partial government shutdown and raise the debt limit, but investors are taking a cautious approach. Even if the Senate gets a deal, it still needs to win support in the House of Representatives, which is far from certain. And there were reports Tuesday morning that the House may push a separate bill.

On the earnings front, Citigroup (C, Fortune 500) was the latest big bank to disappoint investors. The company reported third quarter profits and revenues that fell short of analysts' expectations, sending shares lower. The bank noted that the spike in interest rates over the summer caused a slowdown in new mortgages and refinancings, as well as bond trading.

Coca-Cola (KO, Fortune 500)shares rose after the beverage maker reported an increase in its third-quarter profit, as global sales volume rose 2%. Johnson & Johnson (JNJ, Fortune 500) shares also moved higher after the company reported gains in quarterly sales and profit.

Yahoo (YHOO, Fortune 500) and Intel (INTC, Fortune 500) are set to report in the afternoon.

FedEx (FDX, Fortune 500) shares rose sharply after the shipping giant announced plans to buy back 32 million shares, bolstering its existing share repurchase program.

Tesla (TSLA) and Microsoft (MSFT, Fortune 500) gained ground after analysts upgraded their ratings on the stocks. Wedbush upgraded Tesla to outperform from neutral, while Jefferies boosted Microsoft's rating to buy from hold.

Meanwhile, Facebook (FB, Fortune 500) shares jumped after Evercore analysts said they believe the social media company's stock will rise to $60 and reiterated their overweight rating.

World markets: European markets were pushing higher in afternoon trading. Alastair McCaig, market strategist for IG in London, said he was surprised that European stocks were up given "the sorry shenanigans of Washington."

Though the broa! der market was higher, shares of Burberry (BBRYF) fell nearly 6% in London after the fashion company announced its CEO -- Angela Ahrendts -- would be leaving for the top retail job at Apple (AAPL, Fortune 500).

Most major Asian markets ended the day with modest gains. ![]()

No comments:

Post a Comment