Thursday, October 31, 2013

Absent Higher Rates, Comerica Has Probably Gone Far Enough

Another Familiar Pattern In Second Quarter Earnings

Add Comerica to the list of banks reporting okay net interest income and beating quarterly estimates on the basis of fee income and lower credit costs. Commerce Bancshares (Nasdaq:CBSH) actually reported the opposite, but other banks like Bank of the Ozarks (Nasdaq:OZRK), Wells Fargo (NYSE:WFC) and Citigroup (NYSE:C) have been following this basic pattern for the second quarter.

SEE: Citigroup Continues The Theme Of Decent Big Bank Earnings

Operating revenue declined 2% from the year-ago level, but rose about 1% sequentially. Net interest income declined slightly on a sequential basis as the net interest margin ticked lower (down 5bp) on lower purchase accretion. Again, that slim sequential decline was consistent with Wells Fargo and Citigroup's experiences. Fee income rose 5% sequentially and expenses were flat, leading to a 4% sequential improvement in adjusted pre-provision earnings.

Growth Is Still Lacking

Comerica saw just 1% sequential loan growth, better than Wells Fargo and Citigroup, but weaker than Commerce (which also focuses on commercial lending and is looking to grow its loan book in Texas). Commercial lending was up about 2% over all, though commercial real estate lending was softer. Deposits declined 2% (on an end-of-period basis), marking the second straight sequential decline. With Comercia's capital position on the weaker side of "okay" (at least relative to peers), I'm starting to wonder if this softness in deposits will constrain lending capacity at some point or force the company to turn to more expensive wholesale/borrowed sources of funds.

Quality Improving, But Capital May Be A Little Thin

Comerica reported some solid improvements in multiple credit metrics. Non-performing loans declined 38% from the year-ago level and 9% from the first quarter, and the non-performing asset ratio declined again (from 1.78%/1.18% in the prior year/quarter to 1.05%) - far below the level of Citi and Wells, but more than double the rate of Commerce. The net charge-off ratio dropped again (from 0.42%/0.22% to 0.15%) and is very low.

The reserves are interesting, though. While the decline in non-performing loans has lifted the reserve/NPL percentage to almost 137% (from 93% a year ago), the reserves-to-loans ratio of 1.35% looks a little thin to me, particularly as the the Tier 1 common ratio of 10.4% isn't exactly a peer-leading number. That said, Comerica did fine in the Fed's stress test earlier this year and has the all-clear to return capital to shareholders, which is a meaningful detail in a growth-poor banking industry.

SEE: Foreclosure Activity Tumbles In 1H

The Bottom Line

With close to 10% of Comerica's loan book going to car dealers, Comerica should be taking advantage of a pretty healthy car market in the U.S. Likewise, the company's position in the energy sector ought to be a positive assuming the North American energy market has indeed seen its trough. And as I mentioned earlier, this is a lender with above-average leverage to higher rates, as about 80% of the portfolio is variable rate (with about 70% indexed to 30-day LIBOR).

There aren't too many cheap bank stocks left, though, and Comerica isn't one of them. A 10% estimate for long-term ROE suggests a fair value today in the low-to-mid $30s, and you have to go up to about 13% to get a target ahead of today's price. While Comerica's geographically concentrated business may give it an above-average chance of returning to the higher ROEs of yesteryear, I still think that's a pretty bold assumption to use today. On the other hand, the company's return on tangible assets suggests a fair price/tangible book value multiple of around 1.4x, which implies a fair value of about $47. So not unlike Citi, there seems to be a dichotomy in how the market is viewing/valuing the long-term prospects for some of these banks.

While I think Comerica is a relatively good way to play higher rates, I think at least some of that expectation is already built into the stock price today. With mediocre loan growth and still above-average expenses, I'll continue to be on the sidelines with this stock.

Obamacare: The Exchanges, The Coverage, The Premiums, And The Legal Challenge That Could Shut It Down

Obamacare, if it survives, will represent the most comprehensive overhaul of the American healthcare system since the creation of Medicare in the mid 1960′s. I say, "if it survives" only because, if the system cannot properly facilitate enrollment, if the government cannot enforce its rules, and if the frustration level of the voting public reaches a certain point, Congress may decide to defund it. Additionally, new legal challenges have surfaced which appear credible enough to proceed.

In this article, we'll take a look at the health insurance exchanges, the levels of coverage, some premium examples, and what could happen if any of the new lawsuits succeed.

The Exchanges

Despite numerous differences between supporters and opponents, Obamacare does contain some common ground. The establishment of health insurance exchanges are one example. The exchanges will allow a comparison of premiums on plans with very similar coverage on one website. This should enhance transparency and increase competition which, absent other factors, would have a suppressing effect on premiums. However, many of these "other factors" are significant. Therefore, unless you qualify for a subsidy, it's unlikely your premiums will decrease.

All states were required to establish a healthcare exchange or opt out, in which case its citizens would be compelled to use the federal exchange. According to one source, 17 states have created their own exchange (includes the District of Columbia), 7 will use a "partnership marketplace," and 27 will use the federal exchange. This conflicts with a recent LA Times article which reported, "36 states have decided against opening exchanges for now." Whatever the exact number actually is, before a health insurance plan can be listed on an exchange, it must meet minimum federal requirements for qualified health plans.

States who have created an exchange will retain some discretion over minimum coverage requirements (MCR) and premiums. These states can also decide which policies are allowed on its exchange and which will be excluded. In addition, states with their own exchanges will be able to set higher MCRs and negotiate premium limits with insurers. In short, these states will have some control over their health insurance marketplace.

The Cost of Healthcare.gov: Was It a Good Investment?

Wednesday, October 30, 2013

Wednesday Closing Bell: Markets Can’t Hold Early Gains

October 30, 2013: U.S. markets opened higher again Wednesday morning as investors waited to hear the FOMC announcement later in the day. The ADP employment report came in weak while the consumer price index came in pretty much as expected. Mortgage applications rose for the week and higher crude oil inventories pushed crude prices down.

European markets closed mixed today, while Asian markets closed higher and Latin American markets closed lower.

Thursday's calendar includes the following scheduled data releases and events (all times Eastern):

7:30 a.m. – Challenger job cut report 8:30 a.m. – New claims for unemployment benefits 9:45 a.m. – Chicago PMI 10:30 a.m. – EIA weekly natural gas storage report 3:00 p.m. – Farm prices 4:30 p.m. – Fed balance sheet and money supplyHere are the closing bell levels for Wednesday:

S&P500 1763.31 (-8.64; -0.49%) DJIA 15618.76 (-61.59; -0.39) NASDAQ 3930.62 (-21.72; -0.55%) 10YR TNOTE 2.536% (-0.21875) Gold $1,349.30 (+3.80; +0.3%) WTI Crude oil $96.77 (-1.43; -1.5%) Euro/Dollar: 1.3735 (-0.0011; -0.08%)Big Earnings Movers: LinkedIn Corp. (NYSE: LNKD) is down 9.4% at $223.90 after beating estimates but offering cautious guidance. General Motors Co. (NYSE: GM) is up 3.3% at $37.24 after beating estimates. Comcast Corp. (NASDAQ: CMCSA) is down 1.3% at $47.09 probably due to a loss of cable subscribers. Phillips 66 (NYSE: PSX) is up 1.7% at $65.22 after disappointing earnings. The Western Union Co. (NYSE: WU) is down 12.5% at $16.84 on a poor profit outlook for next year.

Stocks on the Move: NQ Mobile Inc. (NYSE: NQ) is up 11.6% at $12.29 as the company continues to claw its way back from an awful short-seller report. Criteo SA (NASDAQ: CRTO) is up 13.9% at $35.30 following its IPO today. Digital Realty Trust Inc. (NYSE: DLR) is down 15.3% at $49.16 on lowered guidance.

In all, 219 NYSE stocks put up new 52-week highs today, while only 13 stocks posted new lows.

Tuesday, October 29, 2013

Best China Stocks To Watch For 2014

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Canadian Solar (NASDAQ: CSIQ ) jumped 13% today after signing a deal to expand manufacturing.

So what: The company agreed to partner with Samsung Renewable Energy to build a solar manufacturing facility in London, Ontario. The plant will begin construction in 2013 and will supply modules to plants like Samsung's 100 MW projects in Haldimand County and Kingston and Loyalist Township. �

Now what: This is a really great partnership for Canadian Solar and helps solidify it as one of the best manufacturers in China. Not a lot of details have been released about the financial impact this will have on Canadian Solar, and with the company reporting losses each quarter, I'm still leery, but strategically, this looks like a good move. Hopefully this will help push the company into profitability later this year or early next year on the back of higher utilization rates and stabilizing prices in the solar industry.

Interested in more info on Canadian Solar? Add it to your watchlist by clicking here.

Best China Stocks To Watch For 2014: ATA Inc.(ATAI)

ATA Inc., through its subsidiaries, provides computer-based testing services in the People?s Republic of China. It offers services for the creation and delivery of computer-based tests utilizing its test delivery platform, proprietary testing technologies, and testing services; and provides logistical support services relating to test administration. The company?s computer-based testing services are used for professional licensure and certification tests in various industries, including information technology (IT) services, banking, securities, teaching, and insurance. Its e-testing platform integrates various aspects of the test delivery process for computer-based tests ranging from test form compilation to test scoring, and results analysis. ATA also provides career-oriented educational services, such as single course programs, degree major course programs, and pre-occupational training programs focusing on preparing students to pass IT and other vocational certification tests; test preparation and training programs and services to test candidates preparing to take professional certification tests in securities, futures, banking, insurance and teaching industries; online test preparation and training platform for the securities and banking industries; and test preparation software for the teaching industry. In addition, the company offers HR select employee assessment solution, an online system that utilizes its proprietary software and an inventory of test titles to help employers improve the efficiency and accuracy of their employee recruitment process. As of March 31, 2010, it had contractual relationships with 1,988 ATA authorized test centers. The company serves Chinese governmental agencies, professional associations, IT vendors, and Chinese educational institutions, as well as individual test preparation services. ATA Inc. was founded in 1999 and is based in Beijing, the People?s Republic of China.

Best China Stocks To Watch For 2014: BHP Billiton Limited(BHP)

BHP Billiton Limited, together with its subsidiaries, operates as a diversified natural resources company worldwide. The company engages in the exploration, development, and production of oil and gas; mining and refining of bauxite into alumina, and smelting of alumina into aluminum metal; and mining of copper, silver, lead, zinc, molybdenum, uranium, gold, diamonds, and titanium minerals, as well as development of potash deposits. It also involves in the mining and production of nickel products, manganese ore, and manganese metal and alloys, as well as in the mining of iron ore, metallurgical coal, and thermal coal. BHP Billiton Limited sells its copper, lead, and zinc concentrates, and alumina to smelters; copper cathodes to wire rod mills, brass mills, and casting plants; uranium oxide to electricity generating utilities; rough diamonds to diamond buyers and diamond manufacturers; nickel products to stainless steel, specialty alloy, foundry, chemicals, and refractory ma terial industries; metallurgical coal to steel producers; and energy coal to power stations, power generators, and industrial users. The company, formerly known as BHP Limited, was founded in 1885 and is headquartered in Melbourne, Australia.

Advisors' Opinion:- [By Namitha Jagadeesh]

BHP Billiton Ltd. (BHP) and Rio Tinto Group, the world�� largest mining companies, advanced at least 3.5 percent. Repsol SA increased the most in a month after saying it discovered natural gas in Algeria. Lagardere SCA (MMB) lost the most in four months after selling its stake in European, Aeronautic, Defence & Space Co.

- [By Sofia Horta e Costa]

A measure of mining companies listed on the FTSE 350 Index fell 1.7 percent, trimming a 16 percent quarterly advance. Rio Tinto Group and BHP Billiton Ltd. (BHP), the world�� largest mining companies slipped 2.3 percent to 3,067 pence and 2.2 percent to 1,841 pence. Anglo American Plc (AAL) dropped 1.9 percent to 1,540 pence. The shares slid 3.2 percent this week for the biggest decline in almost three months.

- [By Ben Levisohn]

Freeport-McMoRan has gained 0.6% to $33.04 today, bucking weakness in Southern Copper (SCCO), which has dropped 2.7% to $28.18, Rio Tinto (RIO), which has fallen 0.7% to $50.59,�Vale�(VALE), which has decline 0.7% to $16.28 and BHP Billiton (BHP), which is off 0.9% at $67.10.

- [By Geoff Gannon]

��The ranking exercise (is) based on growth and fundamental analysis. EXC ranks at the bottom in both analyses��op 4 results are Apple, BHP Billiton (BHP), Mosaic (MOS) and Rio Tinto (RIO). MOS was eliminated as it has one year of negative FCF.

5 Best Value Stocks To Own For 2014: Top Image Systems Ltd.(TISA)

Top Image Systems Ltd. provides enterprise solutions for managing and validating content entering organizations from various sources. It develops and markets automated data capture solutions for managing and validating content gathered from customers, trading partners, and employees. The company?s solutions deliver digital content to the applications that drive an enterprise by using technologies, such as wireless communications, servers, form processing, and information recognition systems. It offers eFLOW Unified Content Platform that provides the common architectural infrastructure for its solutions. The company also provides Smart, an automated classification solution, which is the eFLOW plug-in for unstructured content providing single point of entry for information entering the organization; and Freedom, the eFLOW plug-in for semi-structured content that enables customers to identify and capture critical data from semi-structured documents, such as invoices, purchase orders, shipping notes, and checks. In addition, it offers Integra, the eFLOW plug-in for structured content, which provides a solution for data capture, validation, and delivery from structured predefined forms; eFLOW Ability, an integrated module interfacing with SAP systems for automated parking, approval, and posting of invoices and other document within SAP systems; and eFLOW Invoice Reader, an invoice capture and approval solution, which could be deployed and integrated in enterprise accounting environment, such as SAP, Oracle, and other financial systems. Top Image Systems Ltd. sells its products through a network of value-added distributors, systems integrators, original equipment manufacturers, and partners in approximately 40 countries worldwide. It has strategic partnership with SQN Banking Systems (SQN) to incorporate SQN's fraud detection solutions with its eFLOW Banking Platform in the Asia Pacific market. The company was founded in 1991 and is headquartered i n Ramat Gan, Israel.

Best China Stocks To Watch For 2014: ChinaCast Education Corporation(CAST)

ChinaCast Education Corporation, together with its subsidiaries, provides post-secondary education and e-learning services in China. The company operates in two segments, E-learning and Training Service Group and Traditional University Group. The E-learning and Training Service Group provides post secondary education distance learning services that enable universities and other higher learning institutions to provide nationwide real-time distance learning services. It also provides K-12 educational services, such as broadcast multimedia educational content services to primary, middle, and high schools; and vocational/career training services. The Traditional University Group segment operates private residential universities that offer four-year bachelor?s degree and three-year diploma programs in finance, economics, trade, tourism, advertising, IT, music, foreign languages, tourism, hospitality, computer engineering, law, and art. The company also provides logistic service s. ChinaCast Education Corporation was founded in 1999 and is headquartered in Central, Hong Kong.

Best China Stocks To Watch For 2014: Trina Solar Limited(TSL)

Trina Solar Limited, through its subsidiaries, designs, develops, manufactures, and sells photovoltaic (PV) modules worldwide. The company offers monocrystalline PV modules ranging from 165 watts to 185 watts in power output; and multicrystalline PV modules ranging from 215 watts to 240 watts in power output that provide electric power for residential, commercial, industrial, and other applications. It also involves in the design and production of various PV modules, such as colored modules for architectural applications and larger sized modules for utility grid applications based on customers? and end-users? specifications. Trina Solar Limited sells and markets its products primarily to distributors, wholesalers, power plant developers and operators, and PV system integrators. The company was founded in 1997 and is based in Changzhou, the People?s Republic of China.

Advisors' Opinion:- [By Travis Hoium]

By some measures, Chinese solar manufacturers are improving. Yesterday, Canadian Solar (NASDAQ: CSIQ ) reported higher-than-expected revenue, a lower loss, and a respectable gross margin of 9.7%. But by others, the market is deteriorating, like Trina Solar's� (NYSE: TSL ) first quarter, when net loss more than doubled from a year ago to $63.7 million.

- [By Travis Hoium]

Who will win the solar panel battle?

Installers, particularly those in residential, deal with this conundrum every day, and the industry is changing rapidly. SolarCity (NASDAQ: SCTY ) has been known to use manufacturers like Trina Solar (NYSE: TSL ) and Yingli Green Energy (NYSE: YGE ) , who are two of the biggest manufacturers in the world and compete mostly on cost. Where system costs are low, they will win business. - [By Gary Bourgeault]

Hit the hardest will probably be Yingli Green Energy (YGE) and Trina Solar (TSL), two of the larger solar manufacturers in China.

Trina Solar

Best China Stocks To Watch For 2014: Focus Media Holding Limited(FMCN)

Focus Media Holding Limited, a multi- platform digital media company, operates out-of-home advertising network using audiovisual digital displays in China. It operates out-of-home advertising network based on the number of locations and flat-panel television displays in its network. The company, through its multi-platform digital advertising network, reaches urban consumers at locations and point-of-interests over various media formats, including audiovisual television displays in buildings and stores, advertising poster frames, outdoor light-emitting diode digital billboards, and Internet advertising platforms. As of June 30, 2010, its digital out-of-home advertising network had approximately 142,000 LCD displays in its LCD display network and approximately 275,000 advertising in-elevator poster and digital frames, installed in approximately 90 cities. The company also provides Internet marketing solutions; and sells software licenses and services, primarily including Adf orward software. Focus Media Holding Limited was founded in 1997 and is based in Shanghai, the People?s Republic of China.

Monday, October 28, 2013

10 Best Dividend Stocks For 2014

Every woman can appreciate when her husband surprises her with jewelry from Tiffany (NYSE: TIF ) , but what about when he splurges on Tiffany stock instead? This week, the luxury retail stock declared a 6% dividend hike, or an additional $0.34 per share. However, does this make the stock a more attractive buy at its current valuation? Let's take a closer look.

Paying it forward

The recent boost in Tiffany's quarterly dividend marks the company's 12th consecutive dividend increase in the past 11 years. Not bad for a company selling high-end products in a beaten-down economy. The stock will now pay shareholders an annual dividend of $1.36 per share.

The new payout puts the stock's dividend yield at around 1.7%. While this is a respectable yield for a retail stock, one luxury retailer has it beat. That's because shares of Coach (NYSE: COH ) now boast a dividend yield of 2%. The luxury goods seller followed Tiffany's lead this week by offering a dividend hike of its own.

10 Best Dividend Stocks For 2014: Cinemark Holdings Inc(CNK)

Cinemark Holdings, Inc. and its subsidiaries engage in the motion picture exhibition business. As of June 30, 2011, it operated 436 theatres with 4,983 screens in 39 states of the United States, as well as in Brazil, Mexico, and 11 other Latin American countries. The company is headquartered in Plano, Texas.

Advisors' Opinion:- [By Rich Smith]

As movie-theater operator Cinemark (NYSE: CNK ) exits the Mexican market, another "gringo" is expanding to fill the gap -- from even farther north of the border.

- [By John Udovich]

The shares of small cap IMAX Corporation (NYSE: IMAX) have slipped more than 10% this week on growth concerns - meaning it might be a good idea to take a closer look at the stock plus its performance�verses other cinema stocks like Carmike Cinemas, Inc (NASDAQ: CKEC), Cinemark Holdings, Inc (NYSE: CNK) and Regal Entertainment Group (NYSE: RGC) along with the PowerShares Dynamic Leisure & Entertainment ETF�(NYSEARCA: PEJ).

10 Best Dividend Stocks For 2014: Torch Energy Royalty Trust(TRU)

Torch Energy Royalty Trust, a grantor trust, holds net profits interests, to receive payments from the working interest owners. Its working interest owners include Torch Royalty Company, Torch E&P Company, Samson Lone Star Limited Partnership, and Constellation Energy Partners LLC. The trust is entitled to receive 95% of the net proceeds attributable to oil and natural gas produced and sold from wells on the underlying properties, including Chalkley Field in Louisiana; the Robinson?s Bend Field in the Black Warrior Basin in Alabama; Cotton Valley Fields in Texas; and Austin Chalk Fields in central Texas. Torch Energy Royalty Trust was founded in 1993 and is based in Wilmington, Delaware.

Top 5 High Tech Stocks To Buy For 2014: Sinclair Broadcast Group Inc.(SBGI)

Sinclair Broadcast Group, Inc., a television broadcasting company, owns or provides certain programming, operating, or sales services to television stations in the United States. The company broadcasts free over-the-air programming, such as network provided programs, news produced locally, local sporting events, programming from program service arrangements, and syndicated entertainment programs. It owns or provides programming and operating services pursuant to local marketing agreements, or provides sales services pursuant to outsourcing agreements to 58 television stations in 35 markets. The company was founded in 1952 and is based in Hunt Valley, Maryland.

Advisors' Opinion:- [By Dan Radovsky]

Sinclair Broadcast Group (NASDAQ: SBGI ) says it is on its way to becoming the nation's largest television broadcasting company if a� definitive agreement it signed with the Allbritton family comes to fruition, according to an announcement today by Sinclair.

- [By Eric Volkman]

Sinclair Broadcast Group (NASDAQ: SBGI ) is tapping the markets in a new, underwritten public share offering. The company has priced its issue of 18 million class A common shares at $27.25 apiece. Sinclair said that certain selling stockholders have granted the underwriters of the offering a 30-day purchase option for up to an additional 2.7 million shares.

- [By Eric Volkman]

In the latest of a string of acquisitions, Sinclair Broadcast Group (NASDAQ: SBGI ) is to buy Fisher Communications (NASDAQ: FSCI ) . The merger transaction will cost the former roughly $373 million. Fisher stockholders are to receive a cash payout of $41.00 per share, which, according to Sinclair, is a 44% premium to the stock's recent closing price.

- [By John Udovich]

Small cap media stock�LIN Media LLC (NYSE: LIN) might not be a household name, but there is a good chance you might be watching the company�� programs because like the Sinclair Broadcast Group, Inc (NASDAQ: SBGI) and Nexstar Broadcasting Group, Inc (NASDAQ: NXST), its helping to consolidate the media industry plus its making investment in other forms of media like social media. The stock has also outperformed those two peers along with the�PowerShares Dynamic Media Portfolio ETF (NYSEARCA: PBS).

10 Best Dividend Stocks For 2014: First Security Group Inc.(FSGI)

First Security Group, Inc. operates as the holding company for FSGBank that provides banking and financial products and services to various communities in eastern and middle Tennessee and northern Georgia. The company offers various deposit services, such as checking, savings, and money market accounts, as well as certificates of deposit. It offers commercial loans, including loans to smaller business ventures, credit lines for working capital, short-term seasonal or inventory financing, and letters of credit; real estate?construction and development loans to residential and commercial contractors and developers; and consumer loans to individuals for personal, family, and household purposes, including secured and unsecured installment and term loans. The company also offers commercial mortgage loans to finance the purchase of real property; commercial leasing for new and used equipment, fixtures, and furnishings to owner-managed businesses; and leasing for forklifts, heavy equipment, and other machinery to owner-managed businesses primarily in the trucking and construction industries. It also provides trust and investment management, mortgage banking, financial planning, and electronic banking services, such as Internet banking, online bill payment, cash management, ACH originations, wire transfers, direct deposit, traveler?s checks, safe deposit boxes, United States savings bonds, and remote deposit capture, as well as equipment leasing. The company operates 38 full-service banking offices and 1 loan and lease production office. Its market areas include in Bradley, Hamilton, Jackson, Jefferson, Knox, Loudon, McMinn, Monroe, Putnam, and Union counties, Tennessee; and Catoosa and Whitfield counties, Georgia. First Security Group was founded in 1974 and is headquartered in Chattanooga, Tennessee.

Advisors' Opinion:- [By Roberto Pedone]

First Security Group (FSGI) operates as the holding company for FSGBank, which provides banking products and services to various communities in Tennessee and Georgia. This stock closed up 6.5% to $2.29 in Tuesday's trading session.

Tuesday's Range: $2.16-$2.30

52-Week Range: $1.30-$7.45

Tuesday's Volume: 80,000

Three-Month Average Volume: 509,606From a technical perspective, FSGI ripped higher here right above some near-term support levels at $2.14 to $2.12 with lighter-than-average volume. This move is quickly pushing shares of FSGI within range of triggering a major breakout trade. That trade will hit if FSGI manages to take out some near-term overhead resistance levels at $2.38 to $2.52 and then once it clears its 200-day moving average at $2.80 with high volume.

Traders should now look for long-biased trades in FSGI as long as it's trending above some key support levels at $2.14 to $2.12 and then once it sustains a move or close above those breakout levels with volume that hits near or above 509,606 shares. If that breakout triggers soon, then FSGI will set up to re-fill some of its previous gap down zone from June that started at $5.08.

10 Best Dividend Stocks For 2014: E.I. du Pont de Nemours and Company(DD)

E. I. du Pont de Nemours and Company operates as a science and technology company worldwide. It operates in seven segments: Agriculture & Nutrition, Electronics & Communications, Performance Chemicals, Performance Coatings, Performance Materials, Safety & Protection, and Pharmaceuticals. The Agriculture & Nutrition segment provides hybrid seed corn and soybean seed, herbicides, fungicides, insecticides, value enhanced grains, and soy protein under the Pioneer brand name. The Electronics & Communications segment supplies materials and systems for photovoltaic products, consumer electronics, displays, and advanced printing. The Performance Chemicals segment offers fluorochemicals, fluoropolymers, specialty and industrial chemicals, and white pigments for various markets, such as plastics and coatings, textiles, mining, pulp and paper, water treatment, and healthcare. The Performance Coatings segment supplies high performance liquid and powder coatings for motor vehicle origi nal equipment manufacturers (OEM); the motor vehicle after-market; and general industrial applications, such as such as coatings for heavy equipment, pipes and appliances, and electrical insulation. The Performance Materials segment provides polymers, elastomers, films, parts, and systems and solutions for the automotive OEM and associated after-market industries, as well as electrical, electronics, packaging, construction, oil, photovoltaics, aerospace, chemical processing, and consumer durable goods. The Safety & Protection segment primarily offers nonwovens, aramids, and solid surfaces for the construction, transportation, communications, industrial chemicals, oil and gas, electric utilities, automotive, manufacturing, defense, homeland security, and safety consulting industries. The Pharmaceuticals segment represents its interest in the collaboration relating to Cozaar/Hyzaar antihypertensive drugs. The company was founded in 1802 and is headquartered in Wilmington, Dela ware.

Advisors' Opinion:- [By Dan Caplinger]

DuPont (NYSE: DD ) is scheduled to release its quarterly earnings report tomorrow, and with its stock at its highest levels in more than a decade, investors are pleased with the company's success lately. But some recent concerns about DuPont's earnings make this quarterly report crucial for the company's future prospects, and a disappointment could set the stage for a reversal in the stock's strong performance.

- [By Jon C. Ogg]

Had the politicians in Washington D.C. not come together,�this article could have been talking about the amazing repeats in history of October stock market crashes. Here are some post-1987 crash levels of existing DJIA components then versus now on a split-adjusted and dividend-adjusted trading basis.

American Express Co.�(NYSE: AXP) was $3.48 then versus $80.52 now. The Coca-Cola Company (NYSE: KO) was $1.12 versus $38.78 now. DuPont (NYSE: DD) was $5.50 then versus $59.62 now. General Electric Co. (NYSE: GE) $1.69 then versus $25.55 now. International Business Machines Corp. (NYSE: IBM) $15.67 then versus $173.78 now. 3M Co. (NYSE: MMM) was $6.63 then versus $122.84 now. McDonald’s Corp.�(NYSE: MCD) was $3.00 then versus $95.20 now.Again, future bear markets and market crashes will come. They always do. Until then, enjoy this raging bull market we have in stocks.

- [By Matt Thalman]

Before we hit the Dow losers, let's look at the index's big winner of the week: DuPont (NYSE: DD ) , which ended the week higher by 7.54% after gaining 4.13% on Tuesday alone. The big move came as the result of DuPont's Q1 results, in which it matched expectations on revenue, beat estimates on earnings per share, and raised its dividend by 5%. The company also reaffirmed its 2013 full-year forecast, which is 2% to 7% higher than what DuPont posted in 2012. �

10 Best Dividend Stocks For 2014: Lockheed Martin Corporation(LMT)

Lockheed Martin Corporation engages in the research, design, development, manufacture, integration, operation, and sustainment of advanced technology systems and products in the areas of defense, space, intelligence, homeland security, and government information technology in the United States and internationally. It also provides management, engineering, technical, scientific, logistic, and information services. The company operates in four segments: Aeronautics, Electronic Systems, Information Systems & Global Services (IS&GS), and Space Systems. The Aeronautics segment offers military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. Its products and programs comprise the F-35 multi-role, stealth fighter; the F-22 air dominance and multi-mission stealth fighter; the F-16 multi-role fighter; the C-130J tactical transport aircraft; and the C-5M strategic airlifter modernization program; and support for the P-3 maritime patrol aircraft, and the U-2 high-altitude reconnaissance aircraft. The Electronic Systems segment provides air and missile defense; tactical missiles; weapon fire control systems; surface ship and submarine combat systems; anti-submarine and undersea warfare systems; land, sea-based, and airborne radars; surveillance and reconnaissance systems; simulation and training systems; and integrated logistics and sustainment services. The IS&GS segment offers information technology solutions and advanced technology primarily in the areas of software and systems integration for space, air, and ground systems to various defense and civil government agencies. The Space Systems segment provides government and commercial satellites; strategic and defensive missile systems, including missile defense technologies and systems, and fleet ballistic missiles; and space transportation systems. Lockheed Martin Corporation was founded in 1909 and is based in Bethesda, Maryland.

Advisors' Opinion:- [By Rich Smith]

Lockheed Martin (NYSE: LMT ) just went four-for-four. In a press release Wednesday, Lockheed Martin described how its new munition for the U.S. Navy's Advanced Gun System (designed for use aboard Zumwalt-class DDG 1000 guided missile destroyers) was fired four times against a variety of targets 45 miles away -- and hit and destroyed each and every one.

- [By Rich Smith]

As already mentioned, 30 contractors are named as recipients, from well-known contractor names such as Booz Allen Hamilton (NYSE: BAH ) , General Dynamics (NYSE: GD ) , Honeywell (NYSE: HON ) , Lockheed Martin (NYSE: LMT ) , and Raytheon (NYSE: RTN ) , all the way down to small businesses with names like PrimeTech International, Metrostar Systems, and Tatitlek Training Services. It is divided into three groupings, with some of the work reserved for section 8(a) Small Businesses and other work only for Reserved Small Business. But the majority of the work is considered "unrestricted," and up for bidding by 19 of the 30 firms named.

10 Best Dividend Stocks For 2014: China Nepstar Chain Drugstore Ltd (NPD)

China Nepstar Chain Drugstore Ltd. operates retail drugstores in the People?s Republic of China. The company?s drugstores provide pharmacy services and other merchandise, including prescription drugs; over-the-counter drugs; nutritional supplements, such as healthcare supplements, vitamins, minerals, and dietary products; herbal products, including drinkable herbal remedies and packages of assorted herbs for making soup; and private label products. Its stores also offer personal care products, such as skin care, hair care, and beauty products; family care products, including portable medical devices for family use, birth control products, and early pregnancy test products; and convenience products, such as soft drinks, packaged snacks, other consumables, cleaning agents, and stationeries, as well as seasonal and promotional items. The company operates its stores under the China Nepstar brand name. As of December 31, 2009, its store network comprised 2,479 retail drugstores located in approximately 71 cities in Guangdong, Jiangsu, Zhejiang, Liaoning, Shandong, Hunan, Fujian, Sichuan, and Hubei provinces, as well as in Shanghai, Tianjin, and Beijing municipalities of the People?s Republic of China. The company was founded in 1995 and is headquartered in Shenzhen, the People?s Republic of China.

10 Best Dividend Stocks For 2014: Reynolds American Inc(RAI)

Reynolds American Inc. (RAI), through its subsidiaries, manufactures and sells cigarette and other tobacco products in the United States. It offers cigarettes under the brand names of CAMEL, PALL MALL, WINSTON, KOOL, DORAL, SALEM, MISTY, and CAPRI; and cigarettes and other tobacco products under the NATURAL AMERICAN SPIRIT brand name, as well as manages various licensed brands, including DUNHILL and STATE EXPRESS 555. The company also provides smokeless tobacco products, including moist snuff under GRIZZLY and KODIAK brand names; pasteurized tobacco under CAMEL Snus brand name; milled tobacco under the brand name of CAMEL Dissolvables; other tobacco products, such as little cigars under WINCHESTER and CAPTAIN BLACK brand names; and roll-your-own tobacco under the brand name of BUGLER. RAI sells its products primarily through distributors, wholesalers, and other direct customers, including retail chains, as well as distributes its cigarettes to public warehouses. The compan y was founded in 1875 and is headquartered in Winston-Salem, North Carolina.

Advisors' Opinion:- [By Dan Caplinger]

Lorillard's success has come from a combination of strategies aimed at diversifying its overall product portfolio. On one hand, the company has vigorously defended its core cigarette market, joining with peer Reynolds American (NYSE: RAI ) to defeat an FDA proposal last year that would have greatly expanded requirements for graphic warning labels on cigarette packaging. Even with an onslaught of ad campaigns and more local smoking restrictions, Lorillard has been able to keep growing, with sales up 3.3% in the first quarter compared to the year-ago quarter and climbing market share for its overall cigarette portfolio and for Newport in particular. Lorillard also got FDA approval for new non-menthol cigarettes last month under the Newport brand, with plans to start marketing Non-Menthol Gold Box and Gold Box 100 products in the near future.

- [By Sean Williams]

Things aren't much better here, either

Domestically, Altria (NYSE: MO ) and Reynolds American (NYSE: RAI ) have performed well, all things considered, with both stocks near an all-time high (adjusting for Altria's spinoff of Philip Morris International). However, the underlying fundamentals of the U.S. tobacco business aren't nearly as good as their stock prices would indicate. Altria laid off 15% of its workforce and Reynolds American 10% in response to falling cigarette volume. Furthermore, in President Obama's budget proposal, the federal cigarette tax would be raised 93% to $1.94 per pack, making it even more burdensome on American consumers to purchase a pack of cigarettes.� - [By Sean Williams]

The end result of these multiple actions has been an ongoing reduction in smoking rates over the past four decades and tougher times for U.S. tobacco producers such as Altria (NYSE: MO ) and Reynolds American (NYSE: RAI ) . In fact, a tough domestic sales climate was one reason Altria decided to spin off its overseas operations into Philip Morris International (NYSE: PM ) in 2008. By separating its business, the hope was that investors would have a better understanding of the fundamental forces driving Altria and Philip Morris.

10 Best Dividend Stocks For 2014: UniSource Energy Corporation(UNS)

UniSource Energy Corporation engages in the electric generation and energy delivery businesses. The company?s TEP segment generates, transmits, and distributes electricity to approximately 403,000 retail electric customers, including residential, commercial, industrial, and public sector customers in southeastern Arizona. It also sells electricity to other utilities and power marketing entities. As of December 31, 2010, this segment owned or leased 2,245 MW of net generating capacity, as well as owned or participated in electric transmission and distribution system consisting of 512 circuit-miles of 500-kV lines; 1,087 circuit-miles of 345-kV lines; 379 circuit-miles of 138-kV lines; 478 circuit-miles of 46-kV lines; and 2,621 circuit-miles of lower voltage primary lines. TEP segment generates electricity from coal, gas, oil, and solar sources. The company?s UNS Gas segment distributes gas to approximately 146,500 retail customers in Mohave, Yavapai, Coconino, and Navajo c ounties in northern Arizona, as well as Santa Cruz County in southeastern Arizona. As of December 31, 2010, this segment?s transmission and distribution system consisted of approximately 30 miles of steel transmission mains, 4,211 miles of steel and plastic distribution piping, and 136,439 customer service lines. The company?s UNS Electric segment transmits and distributes electricity to approximately 91,000 retail customers consisting of residential, commercial, and industrial customers in Mohave and Santa Cruz counties. As of December 31, 2010, UNS Electric?s transmission and distribution system consisted of approximately 56 circuit-miles of 115-kV transmission lines, 271 circuit-miles of 69-kV transmission lines, and 3,599 circuit-miles of underground and overhead distribution lines. This segment also owns the 65 MW Valencia plant, as well as 39 substations having an installed capacity of 1,788,050 kilovolt amperes. The company was founded in 1902 and is based in Tucson, Arizona.

10 Best Dividend Stocks For 2014: P.T. Telekomunikasi Indonesia Tbk.(TLK)

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk provides telecommunication and network services worldwide. The company?s Fixed Wireline segment offers local, domestic long-distance, international telephone services, and other telecommunications services, including leased lines, telex, transponder, satellite, and very small aperture terminal (VSAT), as well as ancillary services. Its Fixed Wireless segment provides local and domestic long-distance code division multiple access-based telephone services, as well as other telecommunication services within a local area code. Perusahaan Perseroan?s Cellular segment offers mobile cellular telecommunication services. Its network services comprise satellite transponder leasing, satellite broadcasting, VSAT, audio distribution, and terrestrial and satellite-based leased lines. The company?s data and Internet services include short messaging service for fixed wire line, fixed wireless, and cellular phones, dial-up and broadband Internet access, virtual private network (VPN) frame relay, Internet protocol (IP) VPN, voice over IP for international calls, integrated services digital network connections, and other multimedia services. The company also provides information services, such as billing, directory assistance, and content services; and wireless application protocol, Web portal, ring back tones, voicemail, and building management services. In addition, it offers consultancy services, as well as constructs and maintains telecommunications facilities; interconnection services; telephone directory production services; and cable and pay television services. As of December 31, 2010, the company served 120.5 million customers, including 8.3 million fixed wireline telephone subscribers, 18.2 million fixed wireless telephone subscribers, and 94.0 million cellular telephone subscribers. Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk was founded in 1884 and is headquartered in Bandung, Indonesia.

Billionaires Hold Data Storage Companies on 52-week Low

Factoring in all of the stocks in the U.S., Canada, Europe, UK, Ireland, Asia and Oceania, GuruFocus research shows the most challenged industry sector worldwide is computer hardware, now number one in the world for the most companies on a 52-week-low. Based on 1,802 computer hardware companies around the world, the global sector shows 242 companies are at a 52-week low, with a low ratio for the industry of 0.13.

This week the U.S. computer hardware sector lists 26 stocks on a 52-week low out of 244 companies, only a fraction of companies worldwide. The low ratio is 0.11. Pulling from that sector, here's a look at two billionaire-held data storage companies and a printed circuit board manufacturer, all on a 52-week low.

U.S. Industry Sector: Computer Hardware

Highlight: Fusion-io Inc. (FIO)

The current FIO share price is $9.54, or 64.0% off the 52-week high of $26.50.

Down 60% over 12 months, Fusion-io Inc. has a market cap of $976.12 million, and trades at a P/B of 1.80. The company does not pay a dividend.

First incorporated in 2005, Fusion-io Inc. is a provider of data-centric computing solutions, using a combination of hardware and software that results in improved performance and efficiency. The company's integrated solutions leverage non-volatile memory to significantly increase datacenter efficiency and offer enterprise grade performance, reliability, availability and manageability. The company sells products and services through its global direct sales force, OEMs including Dell, HP and IBM, and other channel partners.

Guru Action: The top guru stakeholder is Manning & Napier Advisors Inc. as of Sept 30, 2013, when the firm reduced its position by 8.69%, selling 12,340 shares at an average price of $13.18 for a loss of 27.6%.

The firm holds 129,670 shares or 0.13% of shares outstanding.

Over a five-quarter history, Manning & Napier Advisors Inc. has averaged a loss of 59% on 142,010 shares bought at an average price of $23.46 per sha! re. The firm has lost 28% on selling 12,340 shares at an average price of $13.18 per share.

Check out a number of guru stakeholders and very active insider selling.

Historical share pricing, revenue and net income:

[ Enlarge Image ]

[ Enlarge Image ]

Highlight: OCZ Technology Group Inc. (OCZ)

The current OCZ share price is $1.11, or 59.9% off the 52-week high of $2.77.

Down 18% over 12 months, OCZ Technology Group Inc. has a market cap of $75.71 million, and trades at a P/S of 0.29. The company does not pay a dividend.

Formed in 2002, OCZ Technology Group Inc. is a provider of high-performance solid state drives and memory modules for computing devices and systems. The company develops flexible and customizable component solutions quickly and efficiently to meet the ever changing market needs and provide superior customer service.

Guru Action: The top guru stakeholder is Pioneer Investments as of June 30, 2013, with 824,837 shares.

In seven quarters of trading, the firm averaged a loss of 86% on 3,326,558 shares at an average price of $7.82 per share. The firm has averaged a loss of 79% on 2,501,721 shares sold at an average price of $5.39 per share. Pioneer Investments is one of two guru stakeholders. There is no recent insider trading to report.

Historical share pricing, revenue and net income:

[ Enlarge Image ]

[ Enlarge Image ]

Highlight: Multi-Fineline Electronix Inc. (MFLX)

The current MFLX share price is $13.66, or 40.3% off the 52-week high of $22.88.

Down 35% over 12 months, Multi-Fineline Electronix Inc. has a market cap of $328.28 million, and trades at a P/B of 0.90. The company does not pay a dividend.

First incorporated in 1984, Multi-Fineline Electronix Inc. is engaged in the engineering, design and manufacture of flexible printed circuit boards along with related component assemblies. With! faciliti! es in California, China, Malaysia, England and Singapore, the company offers a global service and support base.

Guru Action: The top guru stakeholder is Jim Simons as of June 30, 2013. He holds 125,700 shares or 0.52% of shares outstanding. In the second quarter of 2013, he increased his position by 0.4% when he bought 500 shares at an average price of $15.29 per share. Over a five-year history, he has averaged a loss of 46% on 347,489 shares bought at an average price of $25.40 per share. Selling, Simons has also averaged a loss of 41% on 221,789 shares bought at an average price of $23.14 per share.

Jim Simons is one of four guru stakeholders. There is no recent insider trading to report.

Historical share pricing, revenue and net income:

[ Enlarge Image ]

[ Enlarge Image ]

Be sure to check out the global reach of the GuruFocus Premium Membership for a 7-day Free Trial to access more markets around the world.

If you are not a Premium Member, we invite you for a 7-day Free Trial.

Sunday, October 27, 2013

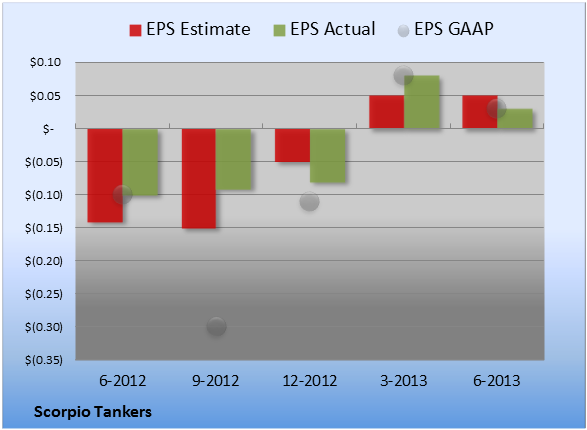

Scorpio Tankers Misses on Both Revenue and Earnings

Scorpio Tankers (NYSE: STNG ) reported earnings on July 29. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended June 30 (Q2), Scorpio Tankers missed estimates on revenues and missed estimates on earnings per share.

Compared to the prior-year quarter, revenue increased significantly. GAAP earnings per share expanded.

Margins grew across the board.

Revenue details

Scorpio Tankers reported revenue of $51.5 million. The seven analysts polled by S&P Capital IQ expected to see revenue of $54.3 million on the same basis. GAAP reported sales were 91% higher than the prior-year quarter's $27.0 million.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

EPS details

EPS came in at $0.03. The 11 earnings estimates compiled by S&P Capital IQ averaged $0.05 per share. GAAP EPS were $0.03 for Q2 against -$0.10 per share for the prior-year quarter.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Margin details

For the quarter, gross margin was 28.5%, much better than the prior-year quarter. Operating margin was 7.5%, much better than the prior-year quarter. Net margin was 7.7%, much better than the prior-year quarter. (Margins calculated in GAAP terms.)

Looking ahead

Next quarter's average estimate for revenue is $58.1 million. On the bottom line, the average EPS estimate is $0.03.

Next year's average estimate for revenue is $227.5 million. The average EPS estimate is $0.21.

Investor sentiment

The stock has a one-star rating (out of five) at Motley Fool CAPS, with 17 members out of 23 rating the stock outperform, and six members rating it underperform. Among seven CAPS All-Star picks (recommendations by the highest-ranked CAPS members), two give Scorpio Tankers a green thumbs-up, and five give it a red thumbs-down.

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on Scorpio Tankers is buy, with an average price target of $11.30.

Is Scorpio Tankers the right energy stock for you? Read about a handful of timely, profit-producing plays on expensive crude in "3 Stocks for $100 Oil." Click here for instant access to this free report.

Add Scorpio Tankers to My Watchlist.Regeneron Jumps 4% as Analysts See Drug Potential

Shares of Regeneron Pharmaceuticals (REGN) have jumped today as two investment banks released positive comments on the drug maker over the weekend following the release of optimistic data about of one of its drugs on Friday.

EPA

EPA RBC Capital Markets analysts Adnan Butt and Michael Yee explain:

Detailed 1-year Phase III DME data for Eylea demonstrated statistically significant vision improvement, comparable efficacy between the every 4 and 8 week Eylea arms, and a clean safety profile. Three positive things relative to the Lucentis Phase III program include: 1) efficacy in a more treatment experienced and tougher patient population, 2) potential for safety differences, especially when it comes to APTC and death events, and 3) every two month dosing that could be on the label. Since REGN will file an sBLA for Eylea by YE:13, potential approval in 2014 could reaccelerate Eylea sales growth, especially once two-year data is available. We believe there could be a pool of hard to treat Lucentis and Avastin patients with [diabetic macular edema], as roughly one-third of patients on Lucentis still had leakage in the Phase III studies.

Butt and Yee raised their price target for Regeneron to $323 from $293.

Cowen’s David Ferreiro, meanwhile, notes that the amount of medicine patients need to take will make a big difference. He writes:

Our diligence suggests that less frequent dosing with Eylea will be key, given the generally low compliance rates among diabetic patients. Currently, we assume only minor market expansion; however, some of our consults suggest Eylea dosing convenience could meaningfully expand the market.

Ferreiro raised his price target to $310 from $300.

Shares of Regeneron have jumped 3.5% to $316.39–and the S&P 500′s best performer today. Novartis (NVS), which makes Lucentis, has dipped 0.5% to $76.73, while Roche (RHHBY), which makes Avastin, has gained 0.2% to $67.54. Vertex Pharmaceuticals (VRTX), meanwhile, has gained 0.9% to $76.77, making it the 10th best perform in the S&P 500.

Saturday, October 26, 2013

Ask Matt: Can ETFs be bought from any broker?

Q: Can ETFs be bought from any broker?

A: Exchange-traded funds, or ETFs for short, are one of the biggest innovations to benefit investors in decades. One of the big draws is that ETFs can be bought just about anywhere that you buy stock.

One of the easiest places to buy ETFs is from online brokerage firms. Like mutual funds, ETFs are investments that own a claim to a basket of assets. But unlike mutual funds, ETFs are traded like stocks and they trade on regulated exchanges.

Due to their unique structure, ETFs can be purchased at any online brokerage firm.

There's a catch though. Since ETFs are stocks, investors who buy them will often incur the same commissions charged to buy standard stocks. If your broker would charge you $10 to buy shares of General Electric, then that same commission might apply to your purchase, and sale, of an ETF. This is very different than mutual funds, which can often be bought with no trading commission from the fund family.

TRACK YOUR STOCKS: Get real-time quotes with our free Portfolio Tracker

Keep in mind

that most of the big online brokers, including TD Ameritrade, Fidelity and Charles Schwab, provide a array of ETFs that are exempt from

normal commission and can be bought and sold with no commission. If you plan to mostly invest in ETFs, look into these deals since they can save you quite a bit of money over time.

Texas Instruments' Earnings Will Be a Turning Point

Texas Instruments (NASDAQ: TXN ) will release its quarterly report next Monday, but shareholders already have seen the stock soar to levels it hasn't seen in years. The question for investors, though, is whether Texas Instruments earnings can finally start growing at a fast-enough pace to justify further share-price gains in the future.

Texas Instruments has made a huge gamble with its business model, choosing to shy away from the highly competitive mobile-chip market in favor of its analog semiconductors and embedded processors. Can those less-sexy areas produce the gains in revenue and earnings that shareholders want to see? Let's take an early look at what's been happening with Texas Instruments over the past quarter and what we're likely to see in its report.

Stats on Texas Instruments

| Analyst EPS Estimate | $0.41 |

| Change From Year-Ago EPS | (6.8%) |

| Revenue Estimate | $3.06 billion |

| Change From Year-Ago Revenue | (8.3%) |

| Earnings Beats in Past 4 Quarters | 4 |

Source: Yahoo! Finance.

Where will Texas Instruments' earnings end up this quarter?

Analysts have raised their earnings views in recent months on Texas Instruments, with a $0.03 per share rise in estimates for the June quarter and triple that increase for the full 2013 year. The stock has also reacted favorably, rising 8% since mid-April.

TI carried considerable momentum into the second quarter from a business perspective, as its first-quarter results were extremely impressive. Even though the company saw revenue drop 8%, Texas Instruments' earnings climbed 37%. Moreover, favorable guidance for the second quarter helped lead analysts to make their positive revisions.

Much of that momentum comes from TI's relentless efforts at innovating. Earlier this month, the company came out with a lower-power radio-frequency transceiver that should help improve efficiency for applications including alarm and security, home and building automation, and smart-grid operations. It also developed a new high-powered LED driver-controller that could be used for vehicle headlamps and other lighting needs.

Yet last month, TI issued a forecast that disappointed some investors, narrowing its previous earnings range and projecting $0.39 to $0.43 in earnings for the June quarter. The company cited weakness in PC and game-console demand as holding back its chips. We saw much the same problems in Intel's (NASDAQ: INTC ) earnings report last night, as the PC-chip giant reduced its revenue forecast for the year amid a 5% drop in overall sales and an almost-30% decline in net income. Unlike TI, Intel is aiming to shift its model toward the mobile market.

The real key for TI will be whether its analog chips can gain greater application. General Electric's Industrial Internet project continues to move forward, and connecting networks of machines in order to improve communication and gather data should require plenty of sensor-chips of the type in which TI specializes. Moreover, Cisco Systems and its Internet of Things initiative also have promise both for TI and for Freescale Semiconductor (NYSE: FSL ) , which came out with a new microcontroller chip earlier this year that could potentially work together with TI-made Wi-Fi transmitted chips to facilitate communication. Freescale is tiny compared to TI, but a partnership there could help both companies make more from the opportunity than they could separately.

In Texas Instruments' earnings report, look closely for which strategic direction TI chooses to take in trying to bolster its growth. Investors aren't going to wait forever for the company's strategy to play out, and the stock's best chance at further gains is for TI to identify growth markets that won't be overly sensitive to the industry's usual cyclical trends.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

Click here to add Texas Instruments to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

Friday, October 25, 2013

Top Warren Buffett Stocks To Buy Right Now

In this segment of The Motley Fool's everything-financials show,�Where the Money Is, banking analysts Matt Koppenheffer and David Hanson discuss a recent move by Berkshire Hathaway to add to one of its stock positions.

David tells viewers why this is something every investor can learn from.

The price of becoming the world's greatest investor is that Warren Buffett can no longer make many of types of investments that made him rich in the first place. Find out about one such opportunity in "The Stock Buffett Wishes He Could Buy." The free report details a sector of the economy Buffett's heavily invested in right now and exactly why he can't buy one attractive company in that sector. Click here to keep reading.�

Editor's note: In the above video, David states that DaVita's share price is $17 -- the correct price at the time of filming was $117.

You can follow�David�and�Matt�on Twitter.

Top Warren Buffett Stocks To Buy Right Now: Accenture plc. (ACN)

Accenture plc provides management consulting, technology, and business process outsourcing services worldwide. It offers various management consulting services in the areas of finance and enterprise performance, operations, risk management, sales and customer service, strategy, sustainability, and talent and organization management, as well as provides industry-specific management consulting services. The company also offers system integration consulting services and solutions, including enterprise solutions and enterprise resource planning, industry and functional solutions, information management services, custom solutions, and Microsoft solutions; and technology consulting services and solutions comprising information technology (IT) strategy, infrastructure consulting, IT security consulting, and application modernization and optimization. In addition, it provides technology outsourcing services, which include application outsourcing services; infrastructure outsourcin g services in service desk, workplace, data-center, network, security, and IT spend management service areas; cloud computing services; and mobility and embedded software services. Further, the company provides business process outsourcing (BPO) services for business functions and/or processes, including finance and accounting, human resources, learning and procurement, and others, as well as industry-specific BPO services, such as credit services. It serves communications, electronics and high technology, media and entertainment, banking, capital markets, insurance, health, public service, airlines, freight and logistics, automotive, consumer goods and service, industrial equipment, infrastructure and transportation service, life sciences, retail, chemical, energy, natural resources, and utility industries. Accenture plc has a strategic collaboration with Marriott International, Inc. The company was founded in 1995 and is based in Dublin, Ireland.

Advisors' Opinion:- [By Lu Wang]

Accenture (ACN) slipped 2.4 percent to $74.09. The world�� second-largest technology-consulting company forecast earnings that may fall short of analysts��estimates amid increasing competition from Indian providers.

- [By Brian Pacampara]

Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, global consulting giant Accenture (NYSE: ACN ) has earned a respected four-star ranking.

- [By Brian Pacampara]

Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, global consulting giant Accenture (NYSE: ACN ) has earned a respected four-star ranking. �

- [By Keith Speights]

Health care is hot these days. Hospital stocks are sizzling. Pharmaceutical shares are soaring. But there's another way to ride the health care wave. My recommendation is to consider buying Accenture (NYSE: ACN ) stock as a health care investment. Here's why.

Top Warren Buffett Stocks To Buy Right Now: Twin Butte Energy Com Npv (TBE.TO)

Twin Butte Energy Ltd. engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in Western Canada. The company�s principal properties include the Frog Lake property, Silverdale area, Freemont area, and Primate area located in the Lloydminster region of Saskatchewan and Alberta, Canada. It has approximately 220,000 net undeveloped acres of land. The company was founded in 2006 and is headquartered in Calgary, Canada.

Best Biotech Companies To Invest In 2014: Standard Pacific Corp(SPF)

Standard Pacific Corp. operates as a diversified builder of single-family attached and detached homes in the United States. It constructs homes targeting various homebuyers primarily move-up buyers in metropolitan markets in California, Florida, the Carolinas, Texas, Arizona, Colorado, and Nevada. The company also provides mortgage financing services to its homebuyers; and title examination services to its Texas homebuyers. As of December 31, 2011, it owned or controlled 26,444 homesites and had 166 active selling communities. Standard Pacific Corp. was founded in 1965 and is headquartered in Irvine, California.

Top Warren Buffett Stocks To Buy Right Now: Chesnara(CSN.L)

Chesnara plc, together with its subsidiaries, engages in life assurance and pension businesses in the United Kingdom and Sweden. It underwrites various life risks, such as those associated with death, disability, and health, as well as provides a portfolio of investment contracts for the savings and retirement needs of customers through asset management in United Kingdom. The company also underwrites life, accident, and health risks, as well as provides a portfolio of investment contracts in Sweden. It markets its products primarily through independent financial advisers. The company was founded in 1988 and is headquartered in Preston, the United Kingdom.

Top Warren Buffett Stocks To Buy Right Now: Ceragon Networks Ltd.(CRNT)

Ceragon Networks Ltd. offers wireless backhaul solutions that enable cellular operators and other wireless service providers to deliver voice and data services. Its wireless backhaul solutions use microwave technology to transfer large amounts of telecommunication traffic between base stations and the core of the service provider?s network. The company offers Internet protocol (IP) based FibeAir IP-10E/IP-MAX2, a high-capacity Ethernet that is used in wireless backhaul for carriers, private networks, and metro area networks; FibeAir IP-10G/IP-MAX2, a high-capacity multi-service, which is used in wireless backhaul for carriers and private networks; FibeAir 2000/4800, an unlicensed multi-service for private networks and business access; FibeAir/1500R, a high-capacity SDH/SONET for wireless backhaul and metro area networks; and FibeAir 3200T, a high-capacity circuit-switched TDM for wireless backhaul and long distance networks. It also provides advanced pure IP/Ethernet solu tions to wireless broadband service providers, as well as to businesses and public institutions that operate their own private communications networks. In addition, the company offers turnkey project services, including network and radio planning, site survey, solutions development, installation, maintenance, and training services. It sells its products through various channels, including direct sales, original equipment manufacturers, resellers, distributors, and system integrators in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company was formerly known as Giganet Ltd. and changed its name to Ceragon Networks Ltd. in September 2000. Ceragon Networks Ltd. was founded in 1996 and is headquartered in Tel Aviv, Israel.

Top 10 Biotech Companies To Buy Right Now

Baker Bros. Advisors is a ~5 BB small & micro-cap focused biotechnology fund run by Julian Baker and Felix Baker. The fund has generated exceptional returns this year ��largely due to a huge long position they started in ACADIA Pharmaceuticals (NASDAQ: ACAD) (YTD = +481%). While the fund is quite secretive, it is required file SEC Form 13F which allows the public to see which particular biotech stocks are being accumulated.

This allows investors the opportunity to invest alongside the fund in some of its high-risk / high-reward bets. Here are four stocks that have seen recent buying:

Prothena Corp. (PRTA)

Baker Bros. Advisors holds 369,630 shares of PRTA - equivalent to a $7.5 MM stake at time of writing. The company has been adding to PRTA, with the most recent transaction being in Q2 2013 with a net purchase of 177,954 shares.

Top 10 Biotech Companies To Buy Right Now: Medivation Inc.(MDVN)

Medivation, Inc., a biopharmaceutical company, focuses on the development of small molecule drugs for the treatment of castration-resistant prostate cancer, Alzheimer?s disease, and Huntington disease. The company?s product candidates under clinical development include MDV3100, which is in Phase 3 development for the treatment of castration-resistant prostate cancer; and dimebon, which is in Phase 3 clinical trial for the treatment of Alzheimer?s disease and Huntington disease. It has collaboration agreements with Pfizer Inc. to develop and commercialize dimebon; and Astellas Pharma Inc. to develop and commercialize MDV3100. The company was founded in 2003 and is based in San Francisco, California.

Advisors' Opinion:- [By Ben Levisohn]

Werber and Eckhard’s favorites include Gilead (GILD) and Celgene (CELG), and they find the “risk/reward…compelling” in Medivation (MDVN) and Tesaro (TSRO).

- [By Dan Carroll]

Medivation (NASDAQ: MDVN ) shares also were hit hard this week, falling 7.8% over the past five days. Shares fell 8% alone on Monday, after Johnson & Johnson (NYSE: JNJ ) agreed to purchase Aragon Pharmaceuticals in a $1 billion deal. It wasn't a game-changer for J&J, considering Aragon's developmental prostate cancer therapy ARN-509 is in phase 2 trials, although if the company can advance the drug to a regulatory victory down the road, it could one day fill in for J&J's current blockbuster oncology drug Zytiga after its patent expires.

- [By Sean Williams]

What: Shares of biopharmaceutical company Medivation (NASDAQ: MDVN ) sank as much as 11% after rival Johnson & Johnson (NYSE: JNJ ) announced it was purchasing Aragon Pharmaceuticals to get ahold of its experimental advanced prostate cancer drug, ARN-509.

- [By Ben Levisohn]

[The] sell-off in recent days was broad based and…affecting stocks in direct relationship to their volatility and expected duration of negative cash flow. Small and mid cap stocks were most affected (especially post-IPO stocks), and those with major uncertain events looming (MDVN) or with significant revenue upside already built into valuation (PCYC) were among the most severely affected. However, nothing changed in the environment to suggest that those events were any more or less likely to have positive outcomes yesterday, or to suggest that revenue potential was any more or less likely to be achieved than was previously expected.

Top 10 Biotech Companies To Buy Right Now: DiaMedica Inc (DMA)

DiaMedica Inc. (DiaMedica) is a development-stage company. The Company is a biopharmaceutical company engaged in the discovery and development of drugs for the treatment of diabetes and related diseases. DiaMedica's compound, DM-199, is a recombinant human protein for the treatment of both Type I and Type II diabetes and their complications. DiaMedica is starting a Phase I/II clinical trial for DM-199. DM-199 is a recombinant human protein, which improves glucose control, protects beta cells through the expansion of a population of antigen-specific immunosuppressive cells (Tregs), and proliferates insulin producing beta cells through the activation of certain growth factors. The Company�� DM-204 is a G-protein-coupled receptor agonist (GPCR) monoclonal antibody to treat Type II diabetes and some of the associated complication's. activating a receptor resulted in insulin sensitivity, insulin secretion and vasodilation.5 Best Energy Stocks To Invest In 2014: NeoStem Inc (NBS)

NeoStem, Inc., incorporated on September 18, 1980, operates in cellular therapy industry. Cellular therapy addresses the process by which new cells are introduced into a tissue to prevent or treat disease, or regenerate damaged or aged tissue, and consists of a separate therapeutic technology platform in addition to pharmaceuticals, biologics and medical devices. The Company�� business model includes the development of novel cell therapy products, as well as operating a contract development and manufacturing organization (CDMO) providing services to others in the regenerative medicine industry. Progenitor Cell Therapy, LLC, the Company�� wholly owned subsidiary (PCT), is a CDMO in the cellular therapy industry. PCT has provided pre-clinical and clinical current Good Manufacturing Practice (cGMP) development and manufacturing services to over 100 clients advancing regenerative medicine product candidates through rigorous quality standards all the way through to human testing.

PCT has two cGMP, cell therapy research, development, and manufacturing facilities in New Jersey and California, serving the cell therapy community with integrated and regulatory compliant distribution capabilities. Its core competencies in the cellular therapy industry include manufacturing of cell therapy-based products, product and process development, cell and tissue processing, regulatory support, storage, distribution and delivery and consulting services. The Company�� wholly-owned subsidiary, Amorcyte, LLC (Amorcyte) is developing its own cell therapy, AMR-001, for the treatment of cardiovascular disease. AMR-001 represents its clinically advanced therapeutic product candidate and enrollment for its Phase II PreSERVE clinical trial to investigate AMR-001's safety and efficacy in preserving heart function after a heart attack in a particular type of post Acute Myocardial Infarction (AMI) patients.

Through the Company�� subsidiary, Athelos Corporation (Athelos), the Company is collaborating w! ith Becton-Dickinson in early stage clinical development of a therapy utilizing T-cells, collaborating for autoimmune and inflammatory conditions, including but not limited to, graft vs. host disease, type 1 diabetes, steroid resistant asthma, lupus, multiple sclerosis and solid organ transplant rejection. The Company�� pre-clinical assets include its Very Small Embryonic Like (VSEL) Technology platform. The Company has basic research and development capabilities, manufacturing facilities on both the east and west coast of the United States.

Advisors' Opinion:- [By John Udovich]

From stem cell burgers to earnings reports, the stem cell industry and small cap players in it like NeoStem Inc (NASDAQ: NBS), International Stem Cell Corp (OTCMKTS: ISCO) and BioRestorative Therapies (OTCBB: BRTX) have been producing some news lately that has probably been overlooked by investors and traders alike given its August. Nevertheless, you might want to pay attention to the following stem cell news:

- [By John Udovich]

Summer and the slow news for the market that usually comes with it�is over with and both stem cell researchers or small� cap stem cell stocks like Advanced Cell Technology, Inc (OTCBB: ACTC), Neuralstem, Inc (NYSEMKT: CUR), NeoStem Inc (NASDAQ: NBS), International Stem Cell Corp (OTCMKTS: ISCO)�and BioRestorative Therapies (OTCBB: BRTX) having news for investors and traders alike. Consider the following:

- [By Monica Gerson]

NeoStem (NYSE: NBS) priced an underwritten public offering of 5,000,000 shares of common stock at an offering price of $7.00 per share. NeoStem shares dipped 9.44% to $7.10 in after-hours trading.

Top 10 Biotech Companies To Buy Right Now: Cell Therapeutics Inc (CTIC.A)

Cell Therapeutics, Inc. (CTI), incorporated in 1991, develops, acquires and commercializes treatments for cancer. The Company�� research, development, acquisition and in-licensing activities concentrate on identifying and developing new ways to treat cancer. As of December 31, 2011, CTI focused its efforts on Pixuvri (pixantrone dimaleate) (Pixuvri), OPAXIO (paclitaxel poliglumex) (OPAXIO), tosedostat, brostallicin and bisplatinates. As of December 31, 2011, it developed Pixuvri, an anthracycline derivative for the treatment of hematologic malignancies and solid tumors. Another late-stage drug candidate of the Company, OPAXIO, is being studied as a potential maintenance therapy for women with advanced stage ovarian cancer, who achieve a complete remission following first-line therapy with paclitaxel and carboplatin. As of December 31, 2011, it also developed tosedostat in collaboration with Chroma Therapeutics, Ltd. (Chroma). On May 31, 2012, CTI completed its acquisi tion gaining worldwide rights to S*BIO Pte Ltd.'s (S*BIO) pacritinib.

Pixuvri