"The problem with QE is that it works in practice but it doesn't work in theory."

- Ben Bernanke, Former Federal Reserve Chairman, January 16, 2014

"When you believe in things that you don't understand, then you suffer. Superstition ain't the way."

- Stevie Wonder, Superstition, 1972

Bernanke clearly meant it as a joke, but it is also an unfortunate statement on recent monetary policy. It's poetic that Stevie Wonder recorded Superstition in 1972, just before the stock market fell by half. A few weeks ago, William Dudley made the same point as Bernanke – even the Fed doesn't quite understand how quantitative easing works. What FOMC officials are really saying is that aside from a very predictable effect on short-maturity interest rates, there is no mechanistic link between the monetary base and any other variables – financial or economic – that they are trying to control. There is a sense that creating more monetary base helps stocks advance, and that this contributes to economic confidence. What's missing is a transmission mechanism that operates through identifiablebanking and economic channels – other than promoting a speculative reach-for-yield and the psychological exuberance that accompanies a bull market.

The fact is that Treasury bond yields are above where they were when QE2 was initiated in 2010, and year-over-year growth in non-farm payrolls, civilian employment, real GDP and real final sales have at best done little but hover at the thresholds that have historically bordered expansion and recession. Good economic policy acts to ease constraints that are binding, and monetary policy can clearly be useful in that regard – particularly during liquidity crises when depositors are rushing for cash. At present, however, quantitative easing acts by massively loosening a constraint that is not binding at all, drowning the economy with idle bank reserves that aren't even desired. That's going to have negative consequences.

The chart below shows the ratio of bank reserves to the M1 money supply. We are increasingly moving away from a "fractional reserve" banking system, as the relationship between reserve creation and lending has collapsed. Idle bank reserves now exceed the amount of demand deposits in the U.S. banking system by more than two-to-one, and exceed 25% of all deposits in the U.S. banking system. Keep in mind that these reserves don't "go into" the stock market (every buyer of stocks is matched by a seller who gets the cash). Rather, these reserves may change owners, but stay in the banking system in aggregate, depressing short-term interest rates, and resulting in a pool of zero-interest deposits that change hands from one uncomfortable holder to another.

The crux of the issue is this. QE only "works" to the extent that zero-interest liquidity is treated as an undesirable "hot potato," forcing investors to seek yield by chasing increasingly speculative assets. Having achieved that end, easy money will do nothing to support stock prices in situations where investors actually find short-term liquidity desirable, or approach speculative assets with the slightest amount of risk-aversion.

Of course, part of the impression that QE is effective also traces to misattribution: the belief that it was responsible for avoiding "global financial meltdown." As I noted in Did Monetary Policy Cause the Recovery?:

"The novelty of quantitative easing, and the misattributed belief that monetary policy ended the banking crisis, has created financial distortions where perception-is-reality, at least for now. We believe that the modifier 'for now' will prove no more durable than it was during the tech bubble or the housing bubble.

"A proper understanding of the credit crisis is essential. Much of the present faith in monetary policy derives from the belief that it was the central factor in ending the banking crisis during what is often called the Great Recession. On careful analysis, however, the clearest and most immediate event that ended the banking crisis was not monetary policy, but the abandonment of mark-to-market accounting by the Financial Accounting Standards Board on March 16, 2009, in response to Congressional pressure by the House Committee on Financial Services on March 12, 2009. The change to the accounting rule FAS 157 removed the risk of widespread bank insolvency by eliminating the need for banks to make their losses transparent. No mark-to-market losses, no need for added capital, no need for regulatory intervention, recievership, or even bailouts. Misattributing the recovery to monetary policy has contributed to a faith in its effectiveness that cannot even withstand scrutiny of the 2000-2002 and 2007-2009 recessions, and the accompanying market plunges. This faith is already wavering, but the loss of this faith will be one of the most painful aspects of the completion of the present market cycle."

On Valuation

Ben Bernanke asserted last week that market valuations seem to be within historical ranges at the moment – which is true, if you take price/earnings ratios wholly at face value, with no adjustment for profit margins, and no consideration of the fact that stocks are long-lived claims on future cash flows. The problem here, as I detailed in An Open Letter to the FOMC: Recognizing the Valuation Bubble in Equities, is that the "equity risk premium" models embraced by Bernanke, Yellen and Greenspan are terribly unreliable compared with methods that account for the cyclical variation in profit margins. The fact is that even if year-to-year earnings are volatile, the discounted value of a long-term stream of those cash flows is very smooth. As a result, the most reliable valuation measures generally have a very smooth denominator. That's why a dozen alternative measures are far better correlated with actual subsequent total returns (these include market cap/GDP, price/revenue, cyclically-adjusted P/E, price-to-record earnings, and others).

If one examines the errors of the Fed-embraced "equity risk premium" models, one immediately finds that those errors are highly (negatively) correlated with the level of profit margins. In other words, the higher profit margins are at any point in time, the worse actual subsequent market returns tend to be, compared with the returns implied by those models. That's not a surprise. If you take cyclically elevated profit margins at face value, you're going to overpay. This is the principal reason that the Fed overlooks valuation risks here.

The chart below shows corporate profits as a share of GDP, with a reminder of how elevated levels relate to subsequent profit growth. I can't emphasize enough that the issue is not what happens to profits over just the next 4 years, however. The issue is whether current profit margins are representative of what investors should expect for the next 50 years. More on that below.

Continue reading:

www.hussman.net

Also check out: John Hussman Undervalued Stocks John Hussman Top Growth Companies John Hussman High Yield stocks, and Stocks that John Hussman keeps buying

About the author:Canadian Valuehttp://valueinvestorcanada.blogspot.com/

| Currently 3.00/512345 Rating: 3.0/5 (6 votes) |

Subscribe via Email

Subscribe RSS Comments

AlbertaSunwapta - 5 hours ago

"At Berkshire we focus almost exclusively on the valuations of individual companies, looking only to a very limited extent at the valuation of the overall market. Even then, valuing the market has nothing to do with where it's going to go next week or next month or next year, a line of thought we never get into. The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value. Sooner or later, though,..."

...

"(2) Corporate profitability in relation to GDP must rise. You know, someone once told me that ... When you begin to expect the growth of a component factor to forever outpace that of the aggregate, you get into certain mathematical problems. In my opinion, you have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%. ... If corporate investors, in aggregate, are going to eat an ever-growing portion of the American economic pie, some other group will have to settle for a smaller portion. That would ..." - Warren Buffett

Mr. Buffett On The Stock Market, By Warren Buffett; Carol Loomis, November 22, 1999

http://money.cnn.com/magazines/fortune/fortune_archive/1999/11/22/269071/

Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

SPY STOCK PRICE CHART

184.18 (1y: +24%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3! ],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[13

Related CSCO Retail Sector Earnings in Focus - Earnings Preview TD Ameritrade's IMX Declines: Equity Market Exposure Decreased, Net Buying Favored Tech Week Ahead: Inflation Data and Wal-Mart Earnings (Fox Business) Related M Retail Sector Earnings in Focus - Earnings Preview Warming Up to Retail: 2 Choices - Analyst Blog Macy's Elevates CMO to President (Fox Business)

Related CSCO Retail Sector Earnings in Focus - Earnings Preview TD Ameritrade's IMX Declines: Equity Market Exposure Decreased, Net Buying Favored Tech Week Ahead: Inflation Data and Wal-Mart Earnings (Fox Business) Related M Retail Sector Earnings in Focus - Earnings Preview Warming Up to Retail: 2 Choices - Analyst Blog Macy's Elevates CMO to President (Fox Business)

Paris vs London: Wooing Chinese tourists

Paris vs London: Wooing Chinese tourists

184.18 (1y: +24%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3! ],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[13

184.18 (1y: +24%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[1368594000000,166.12],[1368680400000,165.34],[1368766800000,166.94],[1369026000000,166.93],[1369112400000,167.17],[1369198800000,165.93],[1369285200000,165.45],[1369371600000,165.31],[1369630800000,165.31],[1369717200000,166.3! ],[1369803600000,165.22],[1369890000000,165.83],[1369976400000,163.45],[1370235600000,164.35],[1370322000000,163.56],[1370408400000,161.27],[1370494800000,162.73],[1370581200000,164.8],[1370840400000,164.8],[1370926800000,163.1],[1371013200000,161.75],[1371099600000,164.21],[1371186000000,163.18],[1371358800000,163.18],[1371445200000,164.44],[1371531600000,165.74],[1371618000000,163.45],[1371704400000,159.4],[1371790800000,159.07],[1372050000000,157.06],[1372136400000,158.58],[1372222800000,160.14],[1372309200000,161.08],[1372395600000,160.42],[1372654800000,161.36],[1372741200000,161.21],[1372827600000,161.28],[1372914000000,161.28],[1373000400000,163.02],[1373259600000,163.95],[1373346000000,165.13],[1373432400000,165.19],[1373518800000,167.44],[1373605200000,167.51],[1373864400000,168.16],[1373950800000,167.53],[1374037200000,167.95],[1374123600000,168.87],[1374210000000,169.17],[1374469200000,169.5],[1374555600000,169.14],[1374642000000,168.52],[1374728400000,168.93],[1374814800000,169.11],[1375074000000,168.59],[1375160400000,168.59],[1375246800000,168.71],[1375333200000,170.66],[1375419600000,170.95],[1375678800000,170.7],[1375765200000,169.73],[1375851600000,169.18],[1375938000000,169.8],[1376024400000,169.31],[1376283600000,169.11],[1376370000000,169.61],[1376456400000,168.74],[1376542800000,166.38],[1376629200000,165.83],[1376888400000,164.77],[1376974800000,165.58],[1377061200000,164.56],[1377147600000,166.06],[1377234000000,166.62],[1377493200000,166],[1377579600000,163.33],[1377666000000,163.91],[1377752400000,164.17],[1377838800000,163.65],[1378098000000,163.65],[1378184400000,164.39],[1378270800000,165.75],[13

He found $2 million of lost art NEW YORK (CNNMoney) Robert Lloyd, a New York antique dealer, holds an unusual distinction: He is the world's largest dealer of Guinness advertising art.

He found $2 million of lost art NEW YORK (CNNMoney) Robert Lloyd, a New York antique dealer, holds an unusual distinction: He is the world's largest dealer of Guinness advertising art.

The FCC pauses its review of the Comcast-Time Warner Cable deal sending the merger potentially in 2015. NEW YORK (CNNMoney) Those waiting for a Comcast-Time Warner Cable merger -- and possibly improved cable service in cities like New York City and Los Angeles -- are going to have to hold out a bit longer.

The FCC pauses its review of the Comcast-Time Warner Cable deal sending the merger potentially in 2015. NEW YORK (CNNMoney) Those waiting for a Comcast-Time Warner Cable merger -- and possibly improved cable service in cities like New York City and Los Angeles -- are going to have to hold out a bit longer.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  Why sex workers are celebrating Obamacare

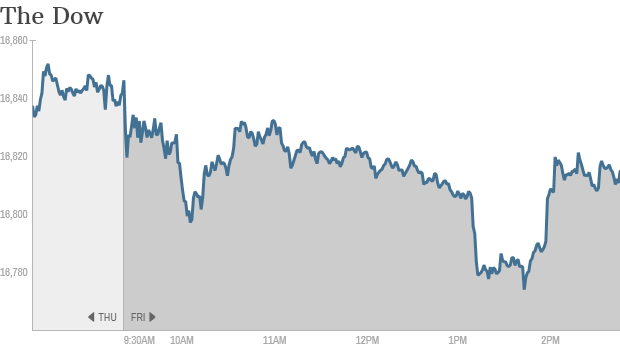

Why sex workers are celebrating Obamacare  NEW YORK (CNNMoney) The Fourth of July is a week away, but there have been a few fireworks this Friday in the stock market.

NEW YORK (CNNMoney) The Fourth of July is a week away, but there have been a few fireworks this Friday in the stock market.  Nike 1, Adidas 0

Nike 1, Adidas 0