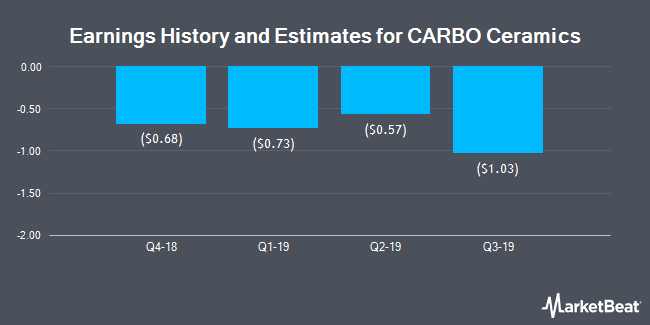

Brokerages forecast that CARBO Ceramics Inc. (NYSE:CRR) will announce ($0.53) earnings per share (EPS) for the current fiscal quarter, according to Zacks. Two analysts have issued estimates for CARBO Ceramics’ earnings, with estimates ranging from ($0.57) to ($0.50). CARBO Ceramics reported earnings of ($0.93) per share in the same quarter last year, which suggests a positive year over year growth rate of 43%. The firm is scheduled to announce its next earnings report on Thursday, July 26th.

Brokerages forecast that CARBO Ceramics Inc. (NYSE:CRR) will announce ($0.53) earnings per share (EPS) for the current fiscal quarter, according to Zacks. Two analysts have issued estimates for CARBO Ceramics’ earnings, with estimates ranging from ($0.57) to ($0.50). CARBO Ceramics reported earnings of ($0.93) per share in the same quarter last year, which suggests a positive year over year growth rate of 43%. The firm is scheduled to announce its next earnings report on Thursday, July 26th.

On average, analysts expect that CARBO Ceramics will report full year earnings of ($1.84) per share for the current financial year, with EPS estimates ranging from ($1.94) to ($1.78). For the next year, analysts expect that the business will report earnings of ($0.21) per share, with EPS estimates ranging from ($0.51) to $0.11. Zacks Investment Research’s EPS averages are a mean average based on a survey of research firms that that provide coverage for CARBO Ceramics.

Get CARBO Ceramics alerts:

CARBO Ceramics (NYSE:CRR) last released its quarterly earnings results on Thursday, April 26th. The oil and gas company reported ($0.83) EPS for the quarter, missing analysts’ consensus estimates of ($0.69) by ($0.14). CARBO Ceramics had a negative return on equity of 20.33% and a negative net margin of 57.60%. The firm had revenue of $49.37 million for the quarter, compared to analysts’ expectations of $57.44 million. During the same period in the prior year, the firm posted ($1.22) earnings per share. CARBO Ceramics’s revenue for the quarter was up 42.3% on a year-over-year basis.

CRR has been the subject of a number of recent analyst reports. Cowen set a $8.00 price target on shares of CARBO Ceramics and gave the stock a “hold” rating in a research note on Thursday, March 15th. ValuEngine raised shares of CARBO Ceramics from a “sell” rating to a “hold” rating in a research note on Wednesday, May 2nd. Finally, Piper Jaffray Companies set a $7.00 price target on shares of CARBO Ceramics and gave the stock a “hold” rating in a research note on Monday, April 2nd. Five analysts have rated the stock with a hold rating, The company currently has a consensus rating of “Hold” and an average price target of $8.81.

In related news, insider Gary A. Kolstad acquired 3,000 shares of the stock in a transaction on Thursday, May 3rd. The stock was bought at an average cost of $8.89 per share, with a total value of $26,670.00. Following the transaction, the insider now directly owns 378,651 shares in the company, valued at $3,366,207.39. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Gary A. Kolstad acquired 10,000 shares of the stock in a transaction on Tuesday, May 1st. The stock was bought at an average cost of $8.49 per share, with a total value of $84,900.00. The disclosure for this purchase can be found here. Over the last three months, insiders acquired 20,000 shares of company stock valued at $180,870. 15.10% of the stock is owned by corporate insiders.

A number of institutional investors have recently added to or reduced their stakes in the business. BlackRock Inc. raised its holdings in shares of CARBO Ceramics by 0.8% in the 1st quarter. BlackRock Inc. now owns 2,832,431 shares of the oil and gas company’s stock valued at $20,534,000 after purchasing an additional 21,926 shares in the last quarter. Wells Fargo & Company MN raised its holdings in shares of CARBO Ceramics by 35.0% in the 1st quarter. Wells Fargo & Company MN now owns 995,235 shares of the oil and gas company’s stock valued at $7,215,000 after purchasing an additional 257,779 shares in the last quarter. Old West Investment Management LLC raised its holdings in shares of CARBO Ceramics by 169.4% in the 1st quarter. Old West Investment Management LLC now owns 994,879 shares of the oil and gas company’s stock valued at $7,212,000 after purchasing an additional 625,634 shares in the last quarter. Schwab Charles Investment Management Inc. raised its holdings in shares of CARBO Ceramics by 22.9% in the 1st quarter. Schwab Charles Investment Management Inc. now owns 510,310 shares of the oil and gas company’s stock valued at $3,700,000 after purchasing an additional 94,994 shares in the last quarter. Finally, Fairfax Financial Holdings Ltd Can raised its holdings in shares of CARBO Ceramics by 10.0% in the 1st quarter. Fairfax Financial Holdings Ltd Can now owns 330,000 shares of the oil and gas company’s stock valued at $2,396,000 after purchasing an additional 30,000 shares in the last quarter. 72.35% of the stock is owned by institutional investors.

Shares of CARBO Ceramics traded up $0.22, reaching $9.23, during trading hours on Tuesday, MarketBeat Ratings reports. 156,500 shares of the stock were exchanged, compared to its average volume of 627,869. CARBO Ceramics has a 12-month low of $6.05 and a 12-month high of $12.69. The company has a current ratio of 4.54, a quick ratio of 2.68 and a debt-to-equity ratio of 0.23. The stock has a market cap of $248.85 million, a PE ratio of -2.44 and a beta of 1.77.

About CARBO Ceramics

CARBO Ceramics Inc, a technology company, provides products and services to the oil and gas, and industrial markets worldwide. The company operates in two segments, Oilfield Technologies and Services, and Environmental Products and Services. The Oilfield Technologies and Services segment manufactures and sells ceramic proppants for use in the hydraulic fracturing of natural gas and oil wells to pressure pumping companies; produces ceramic pellets for use in various industrial technology applications, such as casting and milling; and provides technology to design, build, and optimize the Frac.

Get a free copy of the Zacks research report on CARBO Ceramics (CRR)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

An ascending triangle pattern, a common bullish signal among technical analysts, is formed by linking two trend lines �� the first measures a level of resistance and the second a series of higher lows.

Brokerages forecast that CARBO Ceramics Inc. (NYSE:CRR) will announce ($0.53) earnings per share (EPS) for the current fiscal quarter, according to Zacks. Two analysts have issued estimates for CARBO Ceramics’ earnings, with estimates ranging from ($0.57) to ($0.50). CARBO Ceramics reported earnings of ($0.93) per share in the same quarter last year, which suggests a positive year over year growth rate of 43%. The firm is scheduled to announce its next earnings report on Thursday, July 26th.

Brokerages forecast that CARBO Ceramics Inc. (NYSE:CRR) will announce ($0.53) earnings per share (EPS) for the current fiscal quarter, according to Zacks. Two analysts have issued estimates for CARBO Ceramics’ earnings, with estimates ranging from ($0.57) to ($0.50). CARBO Ceramics reported earnings of ($0.93) per share in the same quarter last year, which suggests a positive year over year growth rate of 43%. The firm is scheduled to announce its next earnings report on Thursday, July 26th.