In 2000, Wal-Mart (WMT) generated $8.2 billion in cash from operations, $6.2 billion (75%) of which went into capital expenditures, like investing in new stores. A far smaller share -- about $1 billion -- was returned to shareholders in the form of dividends and share buybacks. Investing in the future far outweighed rewarding investors today.

In 2012, the tables flipped. Wal-Mart generated $25.6 billion in cash from operations and spent $12.9 billion -- or 50% -- on capital expenditures. Another $13 billion was distributed to shareholders in dividends and buybacks. Investing in the future and rewarding shareholders today took equal precedence.

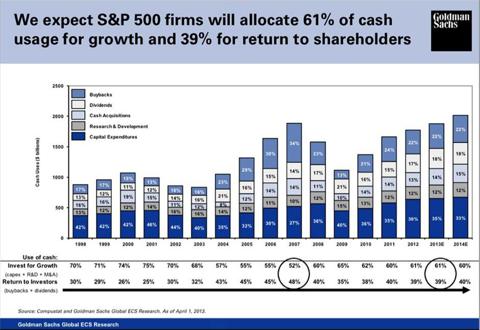

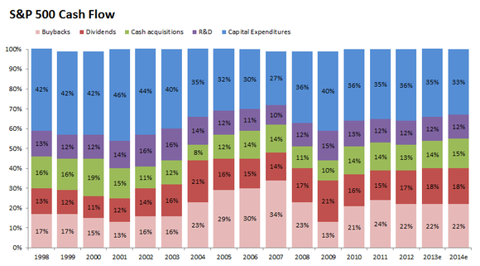

Part of this shift is Wal-Mart maturing from a growth company into a stalwart. But it's actually indicative of how most of corporate America has changed over the last decade. Goldman Sachs recently published a report showing how S&P 500 (SPY) companies have spent their cash over the last 15 years.

(click to enlarge)

(click to enlarge)

Source: Goldman Sachs

If you look carefully at the first graphic, you will note that the FCF for the S&P 500 corporations as a whole was $800 billion in 1998. Since 13% of it was paid out in dividends, we can surmise that the total for dividends paid was $104 billion. Fast forward to 2013 and we have an estimated FCF of $1.9 trillion with 18% of it going out as dividends. That is $342 billion of dividends, or an amount 3.28 times greater than in 1998. That gives us a compound annual growth of total dividends paid out for the last 15 years of 8.24%.

A few trends stick out:

Buybacks are up.Dividends are up.Capital expenditures are down.Part of this is because of a weak economy. No business will invest in a new clothes! shop if consumers don't have enough income to buy more clothes. And given America's demographic headaches and anti-immigrant propaganda from some quarters, businesses would have fewer investment opportunities today compared with a decade ago even if the economy were strong.

Though it's harder to prove, part of this is likely a shift toward short-term thinking among corporate executives. Henry Blodget of Business Insider wrote this weekend:

"The way most companies do business is to focus primarily on today's bottom line: The prevailing ethos in corporate America, after all, is that companies exist to make money for their owners -- and the more and the sooner the better -- so every decision should be made in the context of that.

The result of this is that many (most?) companies scrimp on things like long-term investments, customer service, product quality, and employee compensation, in the interest of delivering a few more pennies to this quarter's bottom line."

Now, corporations may act this way for rational reasons. Most professional investors are judged by short-term performance. Rare is the fund manager who can truly reach for superior long-term investment results; investors give up on managers who suffer a down year, or even a bad quarter. They need companies to produce returns today, even if it comes at the expense of higher returns tomorrow.

There are exceptions, of course. Amazon (AMZN) in recent years has pumped nearly all of its effort into investing in future, profits today be damned. "Amazon, as far as I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers," wrote Matthew Yglesias last year.

But as CEO Jeff Bezos wrote in a letter to shareholders:

"Our heavy investments in Prime, AWS, Kindle, digital media, and customer experience in general strike some as too generous, shareholder indifferent, or even at odds with being a for-profit company ..."

But I! don't th! ink so.

To me, trying to dole out improvements in a just-in-time fashion would be too clever by half. It would be risky in a world as fast-moving as the one we all live in.

More fundamentally, I think long-term thinking squares the circle. Proactively delighting customers earns trust, which earns more business from those customers, even in new business arenas. Take a long-term view, and the interests of customers and shareholders align.

The irony here is that Amazon stock price has produced greater short-term shareholder returns than the vast majority of companies, up 280% in the last five years.

Despite of this, I like what Wal-Mart is doing much more. I believe that only serious form of investing is in companies that have demonstrated the ability to pay and increase dividends year after year.

Alas, for us long-term investors, the hope of buying them on the cheap is diminishing fast since the start of this year. Here are two very alarming news for my fellow cheap stocks lovers:

1.) Goldman Sachs raises its S&P 500 forecast to 1625

2.) The end of the gold hysteria, mourned even by Glenn Beck.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment