Overview

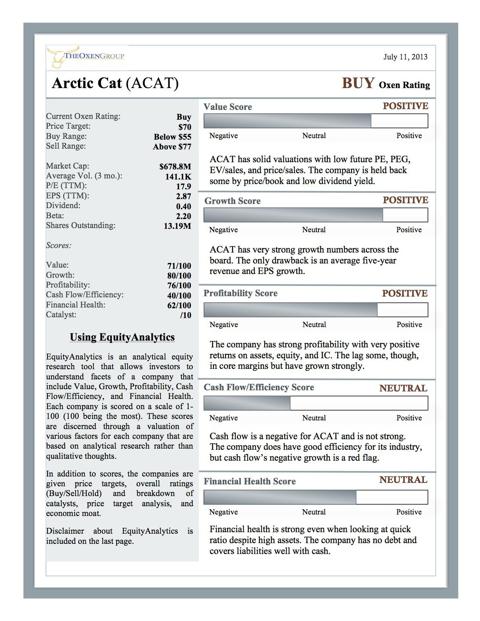

Arctic Cat (ACAT) is a great Buy with strong growth, nice profits, great value, decent financial health, and great catalyst prospects. The company has great growth snowmobile potential this year with new models and is benefiting from a tremendous growth phase in ATVs. We believe the company has tons of upside and is a solid buy.

(click to enlarge)

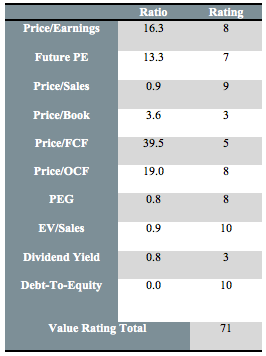

Value

ACAT has pretty solid value and considering the growth of the company, this value is even more appealing. For a company that is expected to see revenue grow by around 15% per year over the next two years, ACAT is priced very cheaply. We tend to look for value in PE under 18 and future PE under 15, which ACAT has both of. Yet, the stock is also in high growth. That discrepancy can be seen in its PEG ratio being at 0.8.

ACAT has pretty solid value and considering the growth of the company, this value is even more appealing. For a company that is expected to see revenue grow by around 15% per year over the next two years, ACAT is priced very cheaply. We tend to look for value in PE under 18 and future PE under 15, which ACAT has both of. Yet, the stock is also in high growth. That discrepancy can be seen in its PEG ratio being at 0.8.

With expected growth of around 12% in 2013 and 2014 in revenue, we would expect a higher valuation. In nearly every capacity, ACAT is cheap. One such indicator that shows it is not is price/book. Why is this show stronger overvaluation?

ACAT has high inventories due to its expensive items and larger inventory at any one given time due to product line. Yet, we see them as cheap and in nearly every other way, which attracts us to this name and tends to signal that future upside is still available especially given that the company has a lot of growth potential moving forward.

This stock is not a value stock per say since its not overly cheap that should be bought for just that reason, but when we combine its value with growth, strong profits, positive catalyst, and lack of concrete competition, the company looks very attractive.

One place we are looking for more production is in the dividend. The yield ! is still quite low below 1%. While it's nice that they have a dividend, we do not foresee a large increase in this rate moving forward. We will discuss this more in the cash flow section.

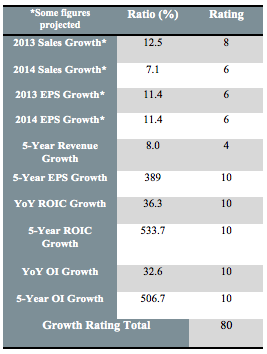

Growth

We are quite bullish on ACAT's growth perspectives. The company's main growth in the FY14 (April 1 - Mar31) will be in the ATV industry. The company expects a 25% growth in the ATV and side-by-side industry. The company expects 5-8% growth in the snowmobile industry as well. The strong growth in ATVs is what will power a lot of the 13% growth expectations overall.

We are quite bullish on ACAT's growth perspectives. The company's main growth in the FY14 (April 1 - Mar31) will be in the ATV industry. The company expects a 25% growth in the ATV and side-by-side industry. The company expects 5-8% growth in the snowmobile industry as well. The strong growth in ATVs is what will power a lot of the 13% growth expectations overall.

The company has been able to grow ATVs so well due to increased domestic demand as well as international growth. The company improved the makeup of sales to around 40% of sales now based in ATVs. The growth of ATVs also helps ACAT deal with seasonality issues of snowmobiles. Snowfall levels have been dropping and causing some issues for the company, and by developing its ATV business, the company can battle that issue.

Sport ATV riding is a growing business and one place that the company expects to see a lot of growth is its side-by-side business with two new models this year that can help bring in some new growth. Further, ATVs are growing for demand all over the world. International growth is really the key to the picture for ACAT. The company's new model combination with expansion into international markets is pushing a lot of growth.

The company has done exceptionally at growing over the past five years, but the company needs to see sustained consumer growth in domestic and international markets to be able to sustain its growth. The company has had easy comps after the recession. A rebound in Europe over the next five years would go a long way for ACAT. The company's over 500% ROIC growth is a tremendous number, and we believe that high ROIC names are great investments.

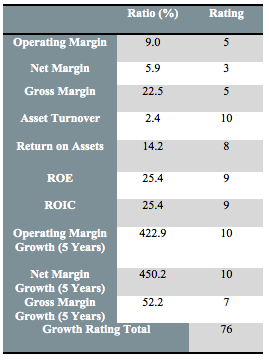

Profita! bility Profitability is another positive for ACAT. The company has very solid profits outside of regular margins, and the company has a large focus on continuing to increase those margins. To start, let's take a look at how the company is doing in comparison to competition. The company's main competitors are Kandi Tech (KNDI), Polaris (PII) and Honda Motors (HMC). We will use operating margins, return on assets, and ROIC for comparison.

Profitability is another positive for ACAT. The company has very solid profits outside of regular margins, and the company has a large focus on continuing to increase those margins. To start, let's take a look at how the company is doing in comparison to competition. The company's main competitors are Kandi Tech (KNDI), Polaris (PII) and Honda Motors (HMC). We will use operating margins, return on assets, and ROIC for comparison.

KNDI has ratios at 8.3%, 4.2%, and 2.8%. PII has ratios at 13.9%, 24.1%, and 43.3%. Finally, HMC sits at 5.5%, 2.9%, and 3.9%. PII is very strong in profitability. Let's dig deeper to see what ACAT is doing that differs from PII. As for operating margins, the company has cost of revenue at 71% of revenue versus PII at 77%. The main difference is that PII has lower costs as compared to sales. PII sells a more premium product than ACAT. That trend should continue. ACAT sells at slightly cheaper price points, but for that reason, they can also increase volumes at a faster rate. One move to partner with Yamaha to create snowmobiles will also decrease gross margins.

Yet, the company is focused on cutting costs, but they want to maintain high R&D to continue to increase their new models to help with growth. We see profits as decently strong right now with the likelihood of potentially slightly increasing over the net five years. The company trails PII but is far above other competition. The company makes great returns on their assets and equity, which should actually be more important to a potential investor. While PII is much better at this, ACAT is also attractive in this area. Both companies are attractive names, but PII is priced much higher.

Cash Flow/Efficiency

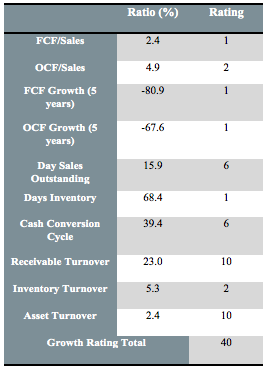

Cash flow is not a place of strength for ACAT, which is a concern for us. The company has very low FCF and OCF margins. Their FCF has declined over the past five years while the company has grown a lot. They have decent efficiency ratings, but they could also use some improvement. Let's start again by taking a look at some industry comparisons with FCF/Sales, Days Inventory, and Cash Conversion Cycle.

Cash flow is not a place of strength for ACAT, which is a concern for us. The company has very low FCF and OCF margins. Their FCF has declined over the past five years while the company has grown a lot. They have decent efficiency ratings, but they could also use some improvement. Let's start again by taking a look at some industry comparisons with FCF/Sales, Days Inventory, and Cash Conversion Cycle.

KNDI sits at -24% FCF margin, 66 days inventory, and 161 CCC. PII is at 10%, 53 DIO, and 37 CCC. Finally, HMC is at -6.3%, 54, and 42. Why is ACAT seeing such low cash flow? The company has incredibly high other working capital cash flow expenditures at $39M. With net income at $40M, the company is seeing a lot cash being directed here. What are other working capital charges?

For ACAT, they are their trading securities. The company took a $39M hit on trading securities to cash flow. That was a $71M gain 2012. The company has money invested in money market funds, and it is negatively impacting their cash flow. We would like to see the company abandon this plan and increase FCF to be able to grow the company even further.

Additionally, the company is at the bottom of the heap in regards to days in inventory. The company's products are taking the longest to sell, which shows demand issues as well as dealership issues. Yet, the company has noted that inventory would increase as new models arrived. So, this could be a ratio that signals more about the fact that the company is changing over a lot of older models rather than struggling. Yet, that still means older models are on the books and taking time to sell, likely being discounted and hurting margins. It's something to watch.

Financial Health

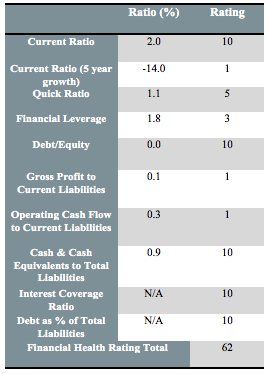

We see Arctic Cat's financial health as fairly solid. The company is just below the positive rating due to low readings in gross p! rofit and! OCF to current liabilities. Yet, the company has very solid cash to total liabilities, debt-to-equity ratio, and even solid quick ratio. That ratio is pretty positive considering the large amount of inventory that the company has, which shows solid health.

We see Arctic Cat's financial health as fairly solid. The company is just below the positive rating due to low readings in gross p! rofit and! OCF to current liabilities. Yet, the company has very solid cash to total liabilities, debt-to-equity ratio, and even solid quick ratio. That ratio is pretty positive considering the large amount of inventory that the company has, which shows solid health.

PII's quick ratio is at 0.9, and the company has better efficiency. We see this as a major positive for ACAT because it means that the company can take on debt very easily and not risk its financial health, which will add value to the company. They could, then, create more FCF and potentially add more to their dividend or do share repurchases. The company's current ratio is very solid at 2.0 as well. We like to see a current ratio under 2.5 and not below 1.5. Above means the company is not utilizing liabilities and missing out potential growth, while too low means the company may have trouble covering its liabilities.

The company, further, wants to continue to clean up its balance sheet. The company maintains focused on its cash position, which allowed it to reinstate its dividend and do a $30M share repurchase. We believe the company may have more opportunities like this in the future as they are already in solid shape with cash and just needs to be redirected in other ways.

With solid growth potential, improving profitability, good financial health, and solid value, ACAT is a great name. While it may play second fiddle to PII, the company is cheaper and has more potential for upside at this time.

Catalysts

We have discussed a bit about some of the potential catalysts for the company as international growth, new models, and expansion of ATVs. We want to dig deeper into these areas in this section.

What kind of demand is there overseas for snowmobiles and ATVs?

We believe it is very solid. ATVs are growing in demand in key markets like Australia China, Mexico, and other emerging markets. The key to these areas is that the consumer is starting to see quite a bit of discretionary spending, and that is the key ! to ATV gr! owth. These are vehicles that are not good for city use or commuting, and so they have to be looked at as strictly discretionary. Expectations are that discretionary spending could triple by 2020 in China to $4.4T. China has a high demand for ATVs and ACAT is growing there. Mexico is looking solid as well. Further, we expect a solid rebound in Europe over the next five years as well. Especially in Eastern Europe where there are lots of open spaces and forests like Poland, Slovakia, and the Czech, ATVs are very popular.

The company's development of the Wildcat side-by-side as also been a huge catalyst and will continue to be. The company is set to launch its Wildcat Four in FY14, which will feature four seats instead of two, as well as a Wildcat X, which is a high horsepower version of the previous model. The company has really benefited from its growth in side-by-side. They had not had a strong foothold in this area for some time due to patents from Polaris, but the company has been able to successfully develop some winning new models. Additionally, the company is expected to launch ten new models of snowmobiles in FY14, which we believe will give that portion of the business a spark that it has been lacking as ATVs and outdoor vehicles have been the growth engine. Further, the company's development of two new engine strategies that should pay dividends over the next five years as well. Further, the engine will be built right here in the USA. The 600cc engine will allow ACAT to enter a part of the market they have never been in before that is 18% of North America's market. These snowmobiles are smaller, but they are very popular. Lower margins on them, but the company can increase volumes as well.

Finally, we believe that the company has a great catalyst in that they deal with little competition outside of Polaris. PII is the leader of the pack, but ACAT has done a great job of being able to be the other player in the room. They have slightly cheaper products, but the pie is growing for thes! e product! s. As that pie gets bigger, ACAT has a big spot in the market. ATVs are definitely a fad that is really going to grow if the economy can take off through 2020 as many expect, and we believe ACAT will benefit from the rise of new consumers as it focuses on new models, diversifying its product lineup, and improving margins.

Price Target Analysis

Step 1.

Project operating income, taxes, depreciation, capex, and working capital for five years. Calculate cash flow available by taking operating income - taxes + depreciation - capital expenditures - working capital.

2014 Projections | 2015 Projections | 2016 Projections | 2017 Projections | 2018 Projections | |

Operating Income | 70 | 78 | 84 | 89 | 91 |

Taxes | 25 | 27 | 29 | 31 | 32 |

Depreciation | 12 | 14 | 17 | 20 | 22 |

Capital Expendit. | -16 | -10 | -12 | -14 | -18 |

Working Capital | 0 | 0 | 0 | 0 | 0 |

! Available! Cash Flow | 42 | 55 | 60 | 64 | 63 |

Step 2.

Calculate present value of available cash flow (PV factor of WACC * available cash flow). You can calculate WACC, but we have given this number to you. The PV factor of WACC is calculated by taking 1 / [(1 + WACC)^# of FY years away from current]. For example, 2016 would be 1 / [(1 + WACC)^4 (2016-2012). WACC for NSIT: 13.1%

2014 | 2015 | 2016 | 2017 | 2018 | |

PV Factor of WACC | 0.9091 | 0.8264 | 0.7513 | 0.6830 | * |

PV of Available Cash Flow | 38 | 45 | 45 | 44 | * |

Step 3.

For the fifth year, we calculate a residual calculation. Taking the fifth year available cash flow and dividing by the cap rate, which is calculated by WACC subtracting out residual growth rate, calculate this number. Companies with high levels of growth have higher residual growth, while companies with lower growth levels have lower residual growth. Cap Rate for ACAT: 10.0%

2017 | |

Available Cash Flow | 63 |

! Divided b! y Cap Rate | 6.0% |

Residual Value | 1052.5 |

Multiply by 20167PV Factor | 0.6830 |

PV of Residual Value | 719 |

Step 4.

Calculate Equity Value - add PV of residual value, available cash flow PVs, current cash, and subtract debt:

Sum of Available Cash Flows | 171 |

PV of Residual Value | 719 |

Cash/Cash Equivalents | 36 |

Interest Bearing Debt | 0 |

Equity Value | 926 |

Step 5.

Divide equity value by shares outstanding:

Equity Value | 926 |

Shares Outstanding | 13.21 |

Price Target | $70 |

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Business relationship disclosure: I have no business relationship with any company whose stock is mentioned in this article. The Oxen Group is a team of analysts. This article was written by David Ristau, one of our writers. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment