1 The Company

One homebuilder has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Beazer Homes USA (BZH) designs, builds, and sells single-family and multi-family homes in the United States.

| Shares outstanding | 26.4 million |

| Share price | $16.84 |

| Market cap | $445.0 million |

| Enterprise value | $1.8 billion |

| P/S | 0.3 |

| Ticker | BZH |

1.1 History

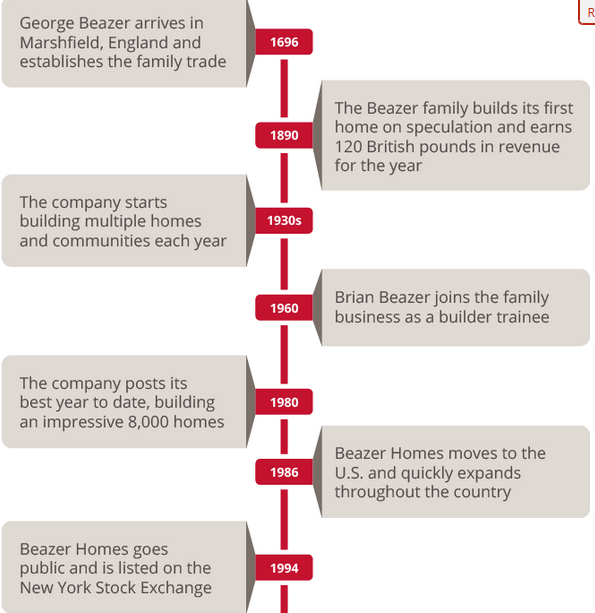

In 1696 George Beazer established the family trade in England. Beazer Homes moved to the U.S. in 1986. In March 1994 Beazer Homes had its initial public offering.

(Source: Beazer Homes)

1.2 Business Model

The company's homes are designed to appeal to homeowners at various price points across various demographic segments and are generally offered for sale in advance of their construction. Beazer Homes' objective is to provide its customers with homes that incorporate exceptional value and quality while seeking to maximize the company's return on invested capital over the course of a housing cycle.

2 Management

The CEO Allan Merrill has more than 20 years of industry experience. Allan Merrill has been CEO since January 2011.

Brian Beazer is the Chairman of the company. Mr. Beazer has been in the homebuilding and construction industry worldwide for over 50 years.

2.1 Insider Ownership

Beazer Homes' directors and executive officers own 3.0% of the company.

Here is a table of Beazer Homes' insider activity during the last 30 days.

| Name | Title | Trade Date | Shares Purchased | Current Ownership | Increase InShares |

| Elizabeth Acton | Director | Aug 5 | 1,000 | 10,560 shares | +10.5% |

| Stephen Zelnak | Director | Aug 4 | 10,000 | 46,017 shares | +27.8% |

| Laurent Alpert | Director | Aug 4 | 2,500 | 20,340 shares | +14.0% |

| Norma Provencio | Director | Aug 1 | 3,000 | 18,240 shares | +19.7% |

| Allan Merrill | CEO | Aug 1 | 10,000 | 179,941 shares | +5.9% |

| Kenneth Khoury | EVP | Aug 1 | 4,672 | 67,390 shares | +7.4% |

| Robert Salomon | CFO | Aug 1 | 7,000 | 53,462 shares | +15.1% |

| Brian Beazer | Chairman | Aug 1 | 10,000 | 63,425 shares | +18.7% |

There have been 47,172 shares purchased by insiders during the last 30 days. Six of these eight insiders increased their holdings by more than 10%.

Here is a table of Beazer Homes' insider activity by calendar month.

| | Insider buying / shares | Insider selling / shares |

| August 2014 | 48,172 | 0 |

| July 2014 | 0 | 0 |

| June 2014 | 17,000 | 0 |

| May 2014 | 0 | 0 |

| April 2014 | 0 | 0 |

| March 2014 | 0 | 0 |

| February 2014 | 0 | 0 |

| January 2014 | 0 | 0 |

| December 2013 | 0 | 0 |

| November 2013 | 0 | 0 |

| October 2013 | 0 | 0 |

| September 2013 | 0 | 0 |

| August 2013 | 0 | 0 |

| July 2013 | 0 | 0 |

| June 2013 | 0 | 0 |

| May 2013 | 0 | 0 |

| April 2013 | 0 | 0 |

| March 2013 | 0 | 0 |

| February 2013 | 0 | 0 |

| January 2013 | 0 | 0 |

There have been 65,172 shares purchased and there have been zero shares sold by insiders since January 2013.

2.2 Compensation

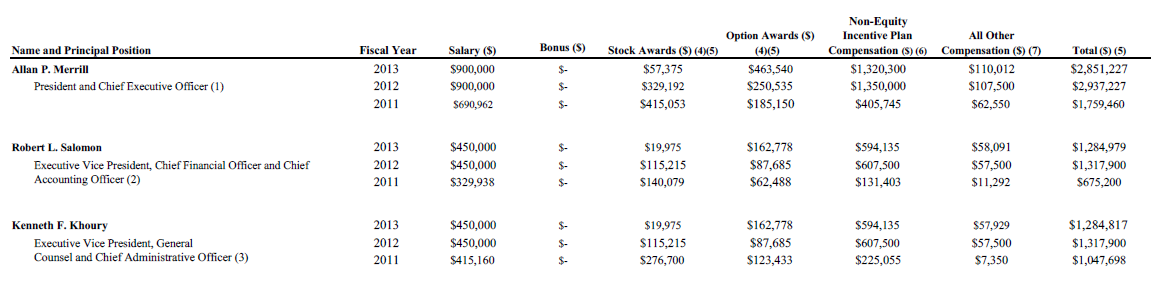

Here is a table of the management's compensation during the last three years.

(Source: Proxy Statement)

The management's total compensation was highest in 2012.

3 Operating Summary

Here is a table of Beazer Homes' number of homes closed and average closing prices.

| Fiscal Year | Number of Homes Closed (Continuing Operations) | Average Closing Price ($ in thousands) |

| 2004 | 16,451 | 232.2 |

| 2005 | 18,109 | 271.3 |

| 2006 | 18,361 | 285.7 |

| 2007 | 12,020 | 277.4 |

| 2008 | 6,370 | 254.3 |

| 2009 | 4,196 | 230.8 |

| 2010 | 4,513 | 221.7 |

| 2011 | 3,249 | 219.4 |

| 2012 | 4,428 | 224.9 |

| 2013 | 5,056 | 253.0 |

The number of homes closed and the average closing prices have been trending higher since 2011.

4 Financial Summary

4.1 Current Situation

Beazer Homes reported the fiscal 2014 third-quarter, which ended June 30, financial results on July 31 with the following highlights:

| Revenue | $354.7 million |

| Net loss | $12.4 million |

| Cash | $206.5 million |

| Debt | $1.5 billion |

| Backlog | $663.2 million |

(Source: Investor presentation)

The revenue grew 12.8% in the quarter compared to the prior year. Beazer Homes posted net income excluding refinancing charge of $6.6 million.

4.2 Historical Developments

Here is a table of Beazer Homes' revenue and earnings since 2004.

| Fiscal Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Revenue ($ in billions) | 3.9 | 5.0 | 5.4 | 3.5 | 1.7 | 1.0 | 1.0 | 0.7 | 1.0 | 1.3 |

| Net income / loss ($ in millions) | +235.8 | +275.9 | +368.8 | -411.1 | -951.9 | -189.4 | -34.0 | -204.9 | -145.3 | -33.9 |

| EPS (diluted) | +29.54 | +29.35 | +42.20 | -53.50 | -123.45 | -24.50 | -2.85 | -13.84 | -7.87 | -1.37 |

(Note: Beazer Homes had an 1-for-5 reverse stock split on October 11, 2012, and a 3-for-1 split on March 22, 2005. The EPS numbers have been adjusted accordingly.)

The revenue has been growing since 2011 and also the net losses have been trending lower since 2011.

5 Shares

Here is a table of Beazer Homes' number of shares since 2004.

| Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Number of shares (basic) (in millions) | 8.3 | 8.1 | 8.0 | 7.7 | 7.7 | 7.7 | 12.0 | 14.8 | 18.5 | 24.7 |

| Number of shares (diluted) (millions) | 8.5 | 9.1 | 8.9 | 7.7 | 7.7 | 7.7 | 12.0 | 14.8 | 18.5 | 24.7 |

(Note: Beazer Homes had an 1-for-5 reverse stock split on October 11, 2012, and a 3-for-1 split on March 22, 2005. The number of shares have been adjusted accordingly.)

Beazer Homes' number of shares (diluted) have grown 191% since 2004.

6 Outlook

Beazer Homes expects its full-year GAAP net income to be above $30 million.

(Source: Investor presentation)

7 Competition

Beazer Homes' competitors include KB Home (KBH), Lennar (LEN), and PulteGroup (PHM). Here is a table comparing these companies.

| Company | BZH | KBH | LEN | PHM |

| Market Cap: | 442.59M | 1.51B | 7.47B | 6.75B |

| Employees: | 878 | 1,430 | 5,741 | 3,843 |

| Qtrly Rev Growth (yoy): | 0.13 | 0.08 | 0.28 | 0.01 |

| Revenue: | 1.36B | 2.18B | 6.70B | 5.64B |

| Gross Margin: | 0.19 | 0.19 | 0.23 | 0.23 |

| EBITDA: | 70.80M | 141.68M | 817.54M | 632.90M |

| Operating Margin: | 0.04 | 0.06 | 0.12 | 0.11 |

| Net Income: | -14.04M | 92.37M | 493.79M | 2.60B |

| EPS: | -0.28 | 0.69 | 2.23 | 6.71 |

| P/E: | N/A | 23.75 | 16.38 | 2.67 |

| PEG (5 yr expected): | 18.58 | 1.89 | 1.51 | 2.00 |

| P/S: | 0.32 | 0.68 | 1.10 | 1.17 |

Beazer Homes has the lowest P/S ratio among these four companies.

8 Valuation

Beazer Homes will have a book value above $20 per share after the removal of the valuation allowance on the company's Deferred Tax Assets.

Allan Merrill commented on the most recent earnings call:

"Finally, once we remove the valuation allowance on our DTA, which we expect to begin doing during fiscal 2015, we'll have the book value above $20 a share. With our earnings potential it seems illogical to me that we would be the only builder to trade below book value."

9 Risks

The homebuilding industry is cyclical. A severe downturn in the industry, as recently experienced, could adversely affect Beazer Homes' business, results of operations and stockholders' equity.

10 Conclusion

There have been eight different insiders buying Beazer Homes and there have not been any insiders selling Beazer Homes this month. The eight insiders purchased their shares at prices ranging from $15.97 to $16.82. I believe Beazer Homes could be a good pick below $16.82 based on the intensive insider buying.

(Source: Investor presentation)

Disclosure: The author has no positions in any stocks mentioned.

About the author:maarnioI have 15 years of investing experience. I have traded stocks, commodities and Forex markets.

Currently 0.00/51234

NEW YORK (TheStreet) -- The day started off with strong employment indicators getting overshadowed by a Russian strike against Western sanctions. That set the tone for a choppy trading session Thursday. The S&P 500 suffered a setback of about 4% from its recent high. A 5% correction would then take the index down about another 16 points to 1,893. The S&P 500 gave up 0.56% to 1,909.57. The Dow Jones Industrial Average was down 0.46% to 16,368.27. The Nasdaq fell 0.46% to 4,334.97. The vast majority of broad market sectors were weak. Down over 1%, health care was the biggest loser, followed by consumer discretionary, basic materials, and energy. Read More: Will Gold's Recent Rally Last -- or Will It Evaporate? "We've entered a whole new level of geopolitical concerns that's creating growth worries for investors who would rather sell U.S. stocks today and ask questions later," said Andrew Wilkinson, chief market analyst at Interactive Brokers. Wall Street's upbeat start was supported by a downtrend in U.S. jobless claims. But the mood quickly soured after Russia retaliated against Western trade sanctions by threatening to ban imports of food and agricultural products from Europe and the U.S. Pressures on the market intensified on news that President Obama was considering airstrikes against violent militants in Iraq who were targeting religious minorities. European Central Bank President Mario Draghi said in a post-ECB press conference that geopolitical risks to the eurozone economy were rising and that the West's strained relations with Russia over Ukraine remains an area of uncertainty for the fragile eurozone economy. CBS (CBS) was flat at $56.91 in after-hours trading after reporting a profit of $439 million, or 76 cents per share, down from $472 million one year ago, but beating analysts' estimates of 72 cents per share. Zynga (ZNGA) was dropping more than 7% to $2.71 after missing analysts' estimates for revenue in the second quarter. Read More: Time Warner vs. 21st Century Fox: What Wall Street's Saying 21st Century Fox (FOXA) reported on Wednesday better-than-expected fiscal fourth-quarter earnings a day after it called off its pursuit of rival media giant Time Warner (TWX). Shares of Fox surged 5.04% to $33.96. Shares of Netflix (NFLX) were up 4.5% to $449.67 after it was reported that CEO Reed Hastings posted on Facebook (FB) that the company has beat Time Warner's HBO in subscriber revenue in the second quarter, adding that Netflix was "honored to be in the same league," according to CNBC. Time Warner shares were down 2.94% to $72.06. Read More: Aug. 7 Premarket Briefing: 10 Things You Should Know --By Andrea Tse in New York Follow @AndreaTTse

How LEGO builds toys kids want NEW YORK (CNNMoney) Lego sure knows how to cash in on criticism. Seven year old Charlotte Benjamin penned a letter that went viral in January, criticizing the company for the lack of professional female Legos. This month, the toy manufacturer rolled out a new set called the Research Institute created by female geophysicist, Ellen Kooijman. The set, which costs $20, features three female scientists -- one paleontologist, one astronomer, and one chemist. It seems to address many of Charlotte's concerns. "All the girls did was sit at home, go to the beach, and shop, and they had no jobs but the boys went on adventures, worked, saved people, and had jobs, even swam with sharks," she wrote. " I want you to make more Lego girl people and let them go on adventures and have fun ok!?! Thank you." The set launched on August 1 and was sold out on Lego's website by Monday. The company wouldn't say how many of the sets it's sold so far, but a spokesman said it was "produced in a limited number for select retailers." It's also for sale in Lego store and at Legoland amusement parks and discovery centers in the US and Canada. This isn't Lego's first attempt to go after the female market -- it introduced Lego Friends in December 2011, targeted specifically to girls. Those sets feature everything from a bakery to a pet salon and a juice bar. But there's a real shortage of women in science and technology fields. According to Girls Who Code, an organization devoted to bridging the computer science skills gender gap, women earn a mere 12 percent of computer science degrees. That's down from 1984, when the figure stood at 37 percent. "Studies show that girls in adolescence start to lose their confidence," said Nathalie Molina Niño, co-founder of Entrepreneurs@Athena, a Barnard College initiative for women entrepreneurs. "That means...you have to catch them before then."

|

Reuters

Reuters  Nati Harnik/AP WASHINGTON -- The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, suggesting the labor market recovery was gaining traction. The economy's brightening outlook was dimmed somewhat by another report Thursday showing a tumble in housing starts and building permits last month. "This part of economy is going in the wrong direction while the rest of the economy is picking up," said Anthony Karydakis, chief economic strategist at Miller Tabak in New York. Initial claims for state unemployment benefits dropped 3,000 to a seasonally adjusted 302,000 for the week ended July 12, the Labor Department said. Economists had forecast first-time applications for jobless aid rising to 310,000. The four-weak average of claims, considered a better gauge of labor market trends as it irons out week-to-week volatility, hit its lowest level in seven years. Prices for U.S. Treasury debt extended gains after the data, while U.S. stock index futures held losses. The claims data covered the survey week for July nonfarm payrolls. Claims fell 12,000 between the June and July survey period, suggesting another month of solid job gains after June's hefty 288,000 increase. Employment has grown by more than 200,000 jobs in each of the last five months, a stretch not seen since the late 1990s.

Nati Harnik/AP WASHINGTON -- The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, suggesting the labor market recovery was gaining traction. The economy's brightening outlook was dimmed somewhat by another report Thursday showing a tumble in housing starts and building permits last month. "This part of economy is going in the wrong direction while the rest of the economy is picking up," said Anthony Karydakis, chief economic strategist at Miller Tabak in New York. Initial claims for state unemployment benefits dropped 3,000 to a seasonally adjusted 302,000 for the week ended July 12, the Labor Department said. Economists had forecast first-time applications for jobless aid rising to 310,000. The four-weak average of claims, considered a better gauge of labor market trends as it irons out week-to-week volatility, hit its lowest level in seven years. Prices for U.S. Treasury debt extended gains after the data, while U.S. stock index futures held losses. The claims data covered the survey week for July nonfarm payrolls. Claims fell 12,000 between the June and July survey period, suggesting another month of solid job gains after June's hefty 288,000 increase. Employment has grown by more than 200,000 jobs in each of the last five months, a stretch not seen since the late 1990s. How LEGO builds toys kids want NEW YORK (CNNMoney) Lego sure knows how to cash in on criticism.

How LEGO builds toys kids want NEW YORK (CNNMoney) Lego sure knows how to cash in on criticism.