Daniel Acker/Bloomberg via Getty Images DETROIT -- General Motors (GM) reported a much lower second-quarter profit Thursday due to numerous recalls and the expected cost of at least $400 million for a compensation fund for those killed or injured by a defective ignition switch linked to at least 13 deaths. GM also reiterated that it expected a moderately improved operating profit this year and that its future recall costs would be slightly higher than historic rates. "We're on or ahead of the plan we shared in January," Chief Financial Officer Chuck Stevens told reporters. "Our expectation is that the second half of the year will be better than the first half." Morgan Stanley analyst Adam Jonas said strong vehicle pricing in North America "saves the quarter." GM earlier this year recalled 2.6 million cars for the faulty ignition switches, which can cause engine stalls and stop power steering and power brakes from operating and air bags from deploying. The company is under investigation by U.S. safety regulators, Congress and the U.S. Department of Justice over its failure to detect the problems for more than a decade. Net income in the quarter fell to $190 million, or 11 cents a share, from $1.2 billion, or 75 cents a share, a year earlier. Excluding one-time items, GM earned 58 cents a share, just below the 59 cents analysts polled by Thomson Reuters I/B/E/S had expected. The company's shares fell 2.9 percent to $36.34 in morning trading. Also Thursday, GM's smaller U.S. rival, Ford Motor (F), posted a higher-than-expected profit on strong results in North America and Europe. One-time items for GM included the charge for establishing the victims' compensation fund, which the company said could still rise by about $200 million, as well as an $874 million charge for a change in how the company will account for recalls in the future. GM previously took charges as recalls occurred, but now it will account for potential future liabilities as the cars are sold and adjust those costs on a quarterly basis, as it does for warranty expenses. For the victim's compensation fund, Stevens said the $400 million figure was based on actuarial data and did not say whether the company expected the number of deaths linked to the defective part to rise. He reiterated that the fund had no cap and that attorney Kenneth Feinberg, who is administering the fund for GM, was not consulted in setting the charge and would determine the final payouts. Safety advocates had previously pushed for GM to put aside $1 billion for the compensation fund, and the company's charge for that was at the low end of Wall Street's expectations. Not counted as one-time items were previously disclosed costs of $1.2 billion for GM recalls, which have covered almost 29 million vehicles so far this year. GM also has $200 million in restructuring costs. Revenue rose slightly to $39.6 billion, but that fell short of the $40.59 billion analysts had expected. Retail sales rose 5.7 percent in both North America and the International Operation unit, which includes China, while falling 11 percent in Europe and 18 percent in South America. GM's North American operating profit, including about $1 billion in recall costs, fell about 30 percent to $1.39 billion. Improved Truck Prices However, higher prices and lower incentives in North America added $800 million. For example, the company was able to get up to $7,000 more for the new Chevrolet Tahoe and GMC Yukon full-size SUVs and about $5,000 more for the newer Chevy Silverado and GMC Sierra full-size pickup trucks, Stevens said. Profit margins in North America reached 9.2 percent, improving year-over-year for the fourth straight quarter. Stevens said they remained on track to reach the company's mid-decade target of 10 percent, but some analysts said the margins were weaker than they expected. In Europe, GM's loss almost tripled to $305 million, largely due to restructuring costs for the planned closure of its plant in Bochum, Germany. Stevens said the company still expected to return to profitability in the region by mid-decade. Ford surprised analysts by posting a profit in Europe, its first in the region in three years. The International Operations' profit rose 36 percent to $315 million. Net income profit margins in China hit 10 percent. South American operations slipped to a loss of $81 million from a year-earlier profit. Stevens said the company expected business there to improve slightly in the second half. MSRP: $26,495 Resale value retained after five years: 50.5 percent Even under Fiat (FIATY) ownership, some elements of Dodge's mouth-breathing, knuckle-dragging, He-Man-Woman-Haters-Club approach to auto sales managed to survive. The built-by-car-guys-for-car-guys Challenger and its rebooted muscle car aesthetic still lingers to lure meatheads who value racing stripes and rims over, oh, just about any other element of their vehicle. Ordinarily, that alone wouldn't make one of these vehicles worth a second look five years from now -- even among the most superficial gearheads. But Fiat helped the Challenger smarten up a little bit by coupling a 305-horsepower V6 engine or 375-horsepower 5.7-liter V8 Hemi with loads of interior space, real-time touchscreen navigation, traffic updates, Bluetooth connectivity, Sirius (SIRI) XM satellite radio, keyless entry/starter and a whole lot of Harman Kardon audio upgrades.

Daniel Acker/Bloomberg via Getty Images DETROIT -- General Motors (GM) reported a much lower second-quarter profit Thursday due to numerous recalls and the expected cost of at least $400 million for a compensation fund for those killed or injured by a defective ignition switch linked to at least 13 deaths. GM also reiterated that it expected a moderately improved operating profit this year and that its future recall costs would be slightly higher than historic rates. "We're on or ahead of the plan we shared in January," Chief Financial Officer Chuck Stevens told reporters. "Our expectation is that the second half of the year will be better than the first half." Morgan Stanley analyst Adam Jonas said strong vehicle pricing in North America "saves the quarter." GM earlier this year recalled 2.6 million cars for the faulty ignition switches, which can cause engine stalls and stop power steering and power brakes from operating and air bags from deploying. The company is under investigation by U.S. safety regulators, Congress and the U.S. Department of Justice over its failure to detect the problems for more than a decade. Net income in the quarter fell to $190 million, or 11 cents a share, from $1.2 billion, or 75 cents a share, a year earlier. Excluding one-time items, GM earned 58 cents a share, just below the 59 cents analysts polled by Thomson Reuters I/B/E/S had expected. The company's shares fell 2.9 percent to $36.34 in morning trading. Also Thursday, GM's smaller U.S. rival, Ford Motor (F), posted a higher-than-expected profit on strong results in North America and Europe. One-time items for GM included the charge for establishing the victims' compensation fund, which the company said could still rise by about $200 million, as well as an $874 million charge for a change in how the company will account for recalls in the future. GM previously took charges as recalls occurred, but now it will account for potential future liabilities as the cars are sold and adjust those costs on a quarterly basis, as it does for warranty expenses. For the victim's compensation fund, Stevens said the $400 million figure was based on actuarial data and did not say whether the company expected the number of deaths linked to the defective part to rise. He reiterated that the fund had no cap and that attorney Kenneth Feinberg, who is administering the fund for GM, was not consulted in setting the charge and would determine the final payouts. Safety advocates had previously pushed for GM to put aside $1 billion for the compensation fund, and the company's charge for that was at the low end of Wall Street's expectations. Not counted as one-time items were previously disclosed costs of $1.2 billion for GM recalls, which have covered almost 29 million vehicles so far this year. GM also has $200 million in restructuring costs. Revenue rose slightly to $39.6 billion, but that fell short of the $40.59 billion analysts had expected. Retail sales rose 5.7 percent in both North America and the International Operation unit, which includes China, while falling 11 percent in Europe and 18 percent in South America. GM's North American operating profit, including about $1 billion in recall costs, fell about 30 percent to $1.39 billion. Improved Truck Prices However, higher prices and lower incentives in North America added $800 million. For example, the company was able to get up to $7,000 more for the new Chevrolet Tahoe and GMC Yukon full-size SUVs and about $5,000 more for the newer Chevy Silverado and GMC Sierra full-size pickup trucks, Stevens said. Profit margins in North America reached 9.2 percent, improving year-over-year for the fourth straight quarter. Stevens said they remained on track to reach the company's mid-decade target of 10 percent, but some analysts said the margins were weaker than they expected. In Europe, GM's loss almost tripled to $305 million, largely due to restructuring costs for the planned closure of its plant in Bochum, Germany. Stevens said the company still expected to return to profitability in the region by mid-decade. Ford surprised analysts by posting a profit in Europe, its first in the region in three years. The International Operations' profit rose 36 percent to $315 million. Net income profit margins in China hit 10 percent. South American operations slipped to a loss of $81 million from a year-earlier profit. Stevens said the company expected business there to improve slightly in the second half. MSRP: $26,495 Resale value retained after five years: 50.5 percent Even under Fiat (FIATY) ownership, some elements of Dodge's mouth-breathing, knuckle-dragging, He-Man-Woman-Haters-Club approach to auto sales managed to survive. The built-by-car-guys-for-car-guys Challenger and its rebooted muscle car aesthetic still lingers to lure meatheads who value racing stripes and rims over, oh, just about any other element of their vehicle. Ordinarily, that alone wouldn't make one of these vehicles worth a second look five years from now -- even among the most superficial gearheads. But Fiat helped the Challenger smarten up a little bit by coupling a 305-horsepower V6 engine or 375-horsepower 5.7-liter V8 Hemi with loads of interior space, real-time touchscreen navigation, traffic updates, Bluetooth connectivity, Sirius (SIRI) XM satellite radio, keyless entry/starter and a whole lot of Harman Kardon audio upgrades.

Friday, July 25, 2014

Recall Costs Take Big Toll on GM's Quarterly Profit

Thursday, July 24, 2014

A Clear Way to Profit from a Graying Population

The Baby Boom generation, which includes everyone born from 1946 through 1964, is now entering retirement age (65) at a rate of 10,000 per day. That demographic wave is so big that in 2010, the U.S. Administration on Aging (AoA) predicted the elderly population in this country would double to about 71 million by 2030.

That presents a huge opportunity for bioscience investors. Here's why.

As people grow older, as a group, they get sicker. About 80% of older adults cope with at least one chronic condition - illnesses that need to be managed but can't be cured - and 50% struggle with two or more. Here are some of them:

Alzheimer's and other dementias Arthritis Balance and gait problems Bladder conditions Cardiovascular disease Cerebrovascular disease Chronic Obstructive Pulmonary Disease (COPD) Depression Diabetes Eye disease (glaucoma, cataracts, macular degeneration) High blood pressure Kidney disease Osteoporosis Parkinson's disease Prostatic hyperplasia (enlarged prostate)Infectious diseases such as pneumonia, and injuries such as hip fractures from falling, also take a big toll on our older adults.

Naturally, the more seniors there are, the more demand there will be on the medical community for better and safer therapies to manage their health.

It's Already HappeningBut that isn't the whole story. Not only are there more elders now than ever before, but they're living longer. According to the Centers for Disease Control and Prevention, life expectancy currently stands at 78.7 years for adults in the United States. Compare that to a century ago, when the average figure was 47.3 years, or a half-century ago, in 1964, when it was 70.3 years.

Thanks to advances in medicine and improved public sanitation, we've made huge strides in longevity. But the outlook isn't as rosy as the numbers suggest, because living longer means more years of dealing with those chronic conditions mentioned above.

All of this costs a lot of money. In 2010, older adults represented only 13% of the population, but accounted for 34% of total healthcare dollars spent. That's $1.3 trillion. And that's a heck of a market.

So as investors, where does all of this take us?

Obviously, with all this demand for better treatment, drugs that help manage chronic conditions associated with age will be on everyone's watch list. And they're already paying off.

Let's take a look at just one of these diseases: adult onset (type 2) diabetes.

Since the beginning of the year, MannKind Corp.'s (Nasdaq: MNKD) price per share (PPS) has risen from $5.31 to $9.70 (as I write this), an increase of more than 80%.

During that time, MNKD's new drug in development, Afrezza, an inhalable form of insulin for type 2 diabetes, received a positive recommendation from a U.S. Food and Drug Administration (FDA) advisory committee (AdCom), and then, a couple of months later, FDA approval. Predictably, both of these catalysts helped drive up PPS.

Immediately after the AdCom, PPS soared more than 100% in a single trading session.

And I suspect Afrezza won't be the last diabetes drug to deliver high profits to investors.

Opportunities AboundIn the coming months, several more new drugs will try to improve the lot of patients with diabetes, including two at opposite ends of the price spectrum...

The first, Evoke Pharma Inc. (Nasdaq: EVOK), will release data from a phase 3 trial of its experimental drug EVK-001, a potential treatment for women with recurrent diabetic gastroparesis. The data follows successful results from a previous phase 2 study of the drug.

Gastroparesis, a common side effect of diabetes, causes the stomach to take too long to empty its contents. Among its symptoms are nausea, vomiting, abdominal pain, bloating, lack of appetite, and weight loss. Up to 4% of the American population - more than 13 million people - suffer with it. A disproportionate number of them are older adults. That's a very big potential market.

Currently, EVOK is a micro cap, with a market capitalization of $42 million and a PPS in the $7 range. This stock could be a remarkable bargain for investors, but trading volume is typically low - an average of about 18,000 shares per day over three months, and currently only around 7,000. Low volume can limit buying/selling opportunities - you can't sell a stock if you can't find a buyer. Short percentage of the float is only around 7%, so the market has some confidence in the company.

The second company, GW Pharmaceuticals Plc. (Nasdaq ADR: GWPH), is a little pricier, with a PPS around $84 and a market cap of nearly $1.5 billion. Shares currently stand at about 950% of their value one year ago.

GWPH creates, develops, and commercializes substances derived from the marijuana plant to treat disease. One of its experimental products, GWP42004, has shown very positive clinical results in a phase 2a trial for the treatment of type 2 diabetes. The company is now doing a placebo-controlled, double-blind study of the drug in diabetic patients, which should be completed by the second half of next year. I would expect successful data to drive up stock value significantly, despite the currently high price tag.

Wealth is there for the finding...

As I say, diabetes is only one example of the many age-associated conditions that will demand more and more attention from the medical research and development community over the coming decade.

There are many more golden opportunities for the investor who is willing to do a little research and find creative bioscience firms developing therapies in these areas.

And remember, these opportunities aren't limited to therapeutics. Long-term care, nursing care, in-home care, and hospice are all areas that should prove attractive to investors.

It's all just a Web search away.

Monday, July 21, 2014

Who Will Follow Kodiak Oil & Gas to Be the Next Bakken Buyout?

Despite the fact that Kodiak Oil & Gas (NYSE: KOG ) has decided to be acquired by Whiting Petroleum (NYSE: WLL ) for slightly less than market value for similar deals recently, Wall Street seems to love the transaction. Both Kodiak and Whiting have seen shares climb by 10.1% and 10.4%, respectively, following the announcement, which suggests there might have been something bigger to the deal. Let's take a look at what has changed recently for Kodiak and how that could impact other smaller players in the Bakken such as Oasis Petroleum (NYSE: OAS ) and Triangle Petroleum (NYSEMKT: TPLM ) .

Source: Chesapeake Energy Media Relations.

Exposing Kodiak's flaw

The first thing that stands out to investors for Kodiak Oil & Gas is its incredible growth story over the past few years. Since the first quarter of 2012 to today, the company has seen production and revenue grow by 7.41 and 7.5 times, respectively. This makes it one of the fastest growing oil producers in the country:

| Company | Production Growth 2011-2013 |

| Kodiak Oil & Gas | 741% |

| Whiting Petroleum | 138% |

| Oasis Petroleum | 317% |

Not only that, but the company has a prime acreage position in the Bakken formation, which is becoming a more prolific oil reserve by the day. Thanks to better drilling technology and more experience in drilling tight oil wells, the total recoverable amount of oil in the region has more than doubled to 7.38 billion barrels of oil since the U.S. Geological Survey's first assessment of the shale play, and top companies in the region even consider that to be a conservative estimate. This means that the 2,100 or so potential drilling locations Kodiak has on its books may only be scratching the surface of this company.

This huge surge in production and Kodiak's push to tap that potential has come at a cost -- its financial health. Along with that revenue growth, its total debt has tripled to $2.25 billion because the company's capital expenditures have been outpacing its cash flow. The theory is that its increased production and revenue would catch up to its debt load, and it would start to generate free cash flow.

In most cases, this theory was starting to work, but one recent change for producers in the Bakken region has changed that dynamic, and that is North Dakota Industrial Commission's decision to limit natural gas flaring at wells. According to the commission, any well that cannot reduce flaring at the well by 74% by October will not be allowed to produce more than 200 barrels per day at each well. Not only will this involve preparing new wells to capture gas, but companies will also need to go back to previous wells. Kodiak doesn't really have the financial flexibility to go back and make those installations at previous wells, nor could it risk having its wells' production be so constrained. By combining forces with Whiting, the combined company will have a bit more financial flexibility to make the necessary fixes at its new and existing wells.

Who's next?

Kodiak Oil & Gas isn't the only one that has employed this growth strategy in the Bakken, and several other companies that are either Bakken-centric or have smaller assets in the region will also struggle with these new regulations. The companies that immediately come to mind are Oasis Petroleum and Triangle Petroleum because they are pure plays, but two other companies that could be at risk here are Halcon Resources (NYSE: HK ) and Magnum Hunter Resources (NYSE: MHR ) . While Magnum Hunter and Halcon do have assets elsewhere, they have both been using the Bakken as a production base to generate revenue while they explore less established shale formations. Based on the cash flow at these companies, they can ill afford to see production limited in the Bakken.

| Company | % Production From Bakken (on Boe basis) | Total Wells in Bakken (net) | % of Capital Expenditures Covered by Operational Cash Flow (LTM) |

| Oasis Petroleum | 100% | 406.2 | 29.2% |

| Triangle Petroleum | 100% | 39.6 | 19.5% |

| Magnum Hunter Resouces | 31% | 98 | 7.2% |

| Halcon Resources | 71% | 188 | 23.8% |

Source: Company 10-ks and S&P capital IQ, authors calculations.

Magnum Hunter has already been in the process of linking its current and upcoming wells to a natural gas gathering system to reduce flaring, so it may be in a better position than the others on this list in that regard. However, if these companies are already struggling to finance operations before these flaring regulations start to take hold, then don't be surprised if they follow a similar path to Kodiak Oil & Gas and sell either its Bakken operations or sell out entirely.

What a Fool believes

The next several months will be very interesting regarding the future of the Bakken. These new regulations will put immense pressure on companies that have not been dealing with natural gas, especially the smaller ones that are already financially stressed. When you add this little wrinkle to the mix, it's a little easier to understand why Kodiak has decided to be acquired by a bigger fish in the Bakken pond for a less than premium price. Investors with a stake in the region should really keep an ear to the ground, because it's very likely that we will see another similar deal soon.

America's $600 billion energy problem means invest in these three stocks today

A dark specter is looming that is ready to stop America's Energy boom right in its tracks, and no one is talking about it. This one critical element could cost us more than $600 billion, but every day we wait, that number grows and grows. The U.S. government thinks investment in this sector is so important, even the Internal Revenue Service will give you a free pass if you invest in this select group of stocks. Our analysts at The Motley Fool have combed over this special class of stocks, and we have identified three that could make you rich! Find out the names of these IRS-gift-wrapped stocks in our special report, "3 Stocks The IRS Is Begging You to Buy." Simply click here, and we'll give you free access to this valuable investing resource.

Saturday, July 19, 2014

Malaysia Airlines Changes Plane Routes to Avoid Ukraine

Phil Nijhuis/APA closed desk of Malaysian airlines is seen at Schiphol airport in Amsterdam on Thursday. KUALA LUMPUR, Malaysia -- Malaysia Airlines says that in the wake of the shooting down of one of its passenger jets over Ukraine, it has changed the route its planes will take on flights to and from Europe. The airline said in a statement Friday on its website that all of its European flights "will be taking alternative routes avoiding the usual route." The plane, which was flying from Amsterdam to Kuala Lumpur, Malaysia, crashed Thursday with 298 people on board Flight 17. American intelligence authorities believe a surface-to-air missile brought the aircraft down but it wasn't yet clear who fired it. "The usual flight route was earlier declared safe by the International Civil Aviation Organization. International Air Transportation Association has stated that the airspace the aircraft was traversing was not subject to restrictions," the airline said in a statement on its website. Even though there were no restrictions, Malaysia Airlines may still face questions about why it continued with flight paths over eastern Ukraine -- at the heart of a violent rebellion against Kiev -- when some airlines decided months ago to change routes to skip around the area. In Seoul, Asiana spokeswoman Lee Hyomin said Asiana had a once-a-week cargo flight that had flown over Ukraine but rerouted the flight in early March amid the worsening situation over the Crimean peninsula. Korean Air Line also said it had rerouted cargo and passenger flights in early March amid the worsening situation over the Crimean peninsula. A company official, who requested anonymity in line with department rules, said Korean Air Line had had 42 flights -- 26 cargo and 16 passenger flights -- which flew over Ukraine before. Likewise, Australia's Qantas stopped flying over Ukraine several months ago and shifted its London-Dubai route 400 miles south. A spokeswoman declined to explain the change. The China Civil Aviation Administration said it instructed all domestic airlines to avoid flying over Ukraine. At present, there are a total of 28 round-trip Chinese flights a week that fly over the area. A statement from Hong Kong's Civil Aviation Department said local "airlines do not use air routes that cross Ukrainian airspace."

Phil Nijhuis/APA closed desk of Malaysian airlines is seen at Schiphol airport in Amsterdam on Thursday. KUALA LUMPUR, Malaysia -- Malaysia Airlines says that in the wake of the shooting down of one of its passenger jets over Ukraine, it has changed the route its planes will take on flights to and from Europe. The airline said in a statement Friday on its website that all of its European flights "will be taking alternative routes avoiding the usual route." The plane, which was flying from Amsterdam to Kuala Lumpur, Malaysia, crashed Thursday with 298 people on board Flight 17. American intelligence authorities believe a surface-to-air missile brought the aircraft down but it wasn't yet clear who fired it. "The usual flight route was earlier declared safe by the International Civil Aviation Organization. International Air Transportation Association has stated that the airspace the aircraft was traversing was not subject to restrictions," the airline said in a statement on its website. Even though there were no restrictions, Malaysia Airlines may still face questions about why it continued with flight paths over eastern Ukraine -- at the heart of a violent rebellion against Kiev -- when some airlines decided months ago to change routes to skip around the area. In Seoul, Asiana spokeswoman Lee Hyomin said Asiana had a once-a-week cargo flight that had flown over Ukraine but rerouted the flight in early March amid the worsening situation over the Crimean peninsula. Korean Air Line also said it had rerouted cargo and passenger flights in early March amid the worsening situation over the Crimean peninsula. A company official, who requested anonymity in line with department rules, said Korean Air Line had had 42 flights -- 26 cargo and 16 passenger flights -- which flew over Ukraine before. Likewise, Australia's Qantas stopped flying over Ukraine several months ago and shifted its London-Dubai route 400 miles south. A spokeswoman declined to explain the change. The China Civil Aviation Administration said it instructed all domestic airlines to avoid flying over Ukraine. At present, there are a total of 28 round-trip Chinese flights a week that fly over the area. A statement from Hong Kong's Civil Aviation Department said local "airlines do not use air routes that cross Ukrainian airspace."

Friday, July 18, 2014

Iraq: What Is The Real Impact On Oil?

Summary A bull trap is currently being set for oil traders. Short-term highs in Exxon Mobil are looking shaky given the broader climate. Sustained performance in USO depends on output productivity, not Iraq military conflicts.

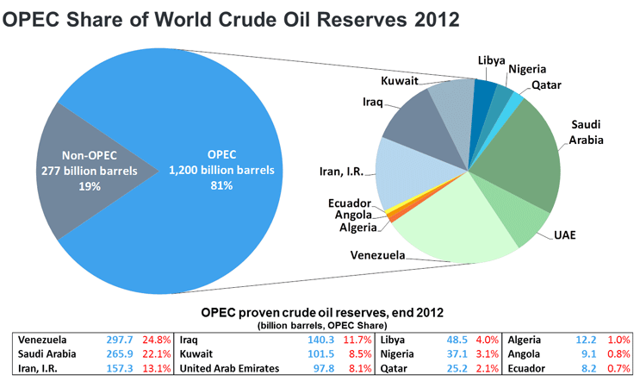

Over the last several decades, political and military turmoil in Iraq has been almost immediately associated with rising oil prices and increased uncertainty in energy markets. From a supply and demand perspective, there are some real and appropriate reasons for why this might occur. Iraq is one of the largest contributors in the Organization of the Petroleum Exporting Countries (OPEC), which accounted for more than 80% of world crude oil reserves, as of 2012 (see chart below).

(Chart Source: OPEC)

So, it is relatively easy to understand why there is a strong association between political turmoil in the Middle East and the potential for rising prices in oil and many other energy markets. This is also why stocks likeExxon Mobil (XOM) have rallied to yearly highs above $100 per share. But the real issue here is the potential supply disruptions in the countries the world relies on for oil production. If we start to see damage to infrastructure, diverted manpower in relevant regions, or obstacles in the way of important trade routes prices tend to rise as the outlook for production output diminishes.

Because of this, it is easy to see why most of the investment community might work itself into a froth any time we start to see news headlines that highlight the potential for political turbulence and military action in these regions. But it is important to remember that "general rules" in the market should not be viewed as applicable in all cases. Here, any trader that is buying into instruments like the United States Oil Fund LP ETF (USO) based on the latest developments in Iraq might be making the right choice (for long-term positions). But those traders would be doing it for the wrong reasons, as any upward impact that is created by the negative situation in Iraq will be temporary and transitory. Scenarios like this are often referred to as bull traps, and should be avoided.

Productivity Levels: US and IraqLet me be perfectly clear: I am bullish on oil and expect prices in USO to be higher at the end of this year than they are now. But the Iraq story is not a real impetus with the ability to sustainably drive prices higher. The forces that really determine price activity are supply and demand, and productivity levels in energy markets continue to hold at the higher end of the historical range.

Efforts in the US to ramp up activity in oil exports has pushed productivity levels to record numbers in a trend that has carried over into the natural gas space as well. Crude stockpiles have reached their highest levels on record (dating back to 1982). But similar environments are seen in Iraq, as well. This is something that has been largely missed by many of those trading commodities. "The fact remains that roughly 90% of the oil shipments coming out of Iraq are released from the country's southern region," saidVlad Karpel, options strategist at TradeSpoon, "and this is an area that has seen relative calm and little downside impact in overall productivity levels."

This is why oil output in Iraq still has the potential to make gains in July. But this is also a bearish factor that is largely ignored in the financial media. This is the current bull trap for oil traders.

Correlated AssetsNext, it will be important to monitor the relative performance of oil's most commonly correlated assets: Gold, the S&P 500, and the US Dollar. It might be easy to assume that any positive moves in oil will carry over into the rest of the commodities space, as well. Higher oil prices have led to projections that alternative commodities ETFs like the SPDR Gold Trust ETF (GLD) andiShares Silver Trust ETF (SLV) will be able to gain traction and move to new highs for the year. But the fact that this has not been the case suggests that the broader global framework is still not conducive to significant bull moves in commodities as a whole. The SPDR S&P 500 Trust ETF (SPY) is still trading at its own record highs but activity in the PowerShares DB US Dollar Index Bullish ETF (UUP) has much better potential to move prices in oil.

(Chart Source: Orbex)

The chart above shows the US Dollar to be in a newly emerging uptrend against the Euro. This creates additional headwinds for oil prices because oil is priced in US Dollars. All of these factors should be taken into account, as the Iraq situation and the supply and demand environment could stall gains in oil and the United States Oil Fund LP ETF.

Currently 0.00/5123

Wednesday, July 16, 2014Homebuilder Confidence Surges on Stronger Sales

Sunday, July 13, 2014Worst Performing Industries For July 7, 2014

Related LWAY Company news for April 02, 2014 - Corporate Summary Earnings Scheduled For March 31, 2014 Related GNCMA Top Performing Industries For June 23, 2014 Zacks Rank #5 Additions for Monday - Tale of the Tape

The Dow dropped 0.28% to 17,020.29, the broader Standard & Poor's 500 index declined 0.26% to 1,980.21 and the NASDAQ composite index fell 0.28% to 4,473.56. The worst performing industries in the market today are: Dairy Products: This industry tumbled 2.12% by 10:50 am. The worst stock within the industry was Lifeway Foods (NASDAQ: LWAY), which fell 0.9%. Lifeway Foods' PEG ratio is 3.56. Long Distance Carriers: This industry fell 1.97% by 10:50 am ET. General Communication (NASDAQ: GNCMA) shares dropped 2.2% in today's trading. General Communication's trailing-twelve-month profit margin is 0.98%. Office Supplies: The industry dropped 1.51% by 10:50 am. The worst performer in this industry was ACCO Brands (NYSE: ACCO), which declined 1.3%. ACCO Brands shares have gained 2.30% over the past 52 weeks, while the S&P 500 index has surged 21.67% in the same period. Toy & Hobby Stores: This industry moved down 1.34% by 10:50 am, with Build-A-Bear Workshop (NYSE: BBW) moving down 1.2%. Build-A-Bear's trailing-twelve-month EPS is $0.16. Posted-In: Worst Performing IndustriesNews Movers & Shakers Intraday Update Markets © 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved. Most Popular Earnings Expectations For The Week Of July 7: Alcoa, Wells Fargo And More #PreMarket Primer: Monday, July 7: Earnings Season Gets Underway Stocks To Watch For July 7, 2014 Alcoa Earnings Preview: A Sign Of Earnings To Come? Boeing Train Derails; Fuselages Dumped In River, Production Disruptions Likely Shares Of GT Advanced Technologies Take A Hit Following UBS Downgrade Related Articles (BBW + ACCO) Worst Performing Industries For July 7, 2014 Top Performing Industries For July 1, 2014 Worst Performing Industries For June 30, 2014 Bed Bath & Beyond (BBBY) Falls: Stock Goes Down 7.2% - Tale of the Tape Weakness Seen in Elizabeth Arden (RDEN): Stock Slumps 17% - Tale of the Tape Sally Beauty Falters, Hits 52-Week Low - Analyst Blog Around the Web, We're Loving... Abercrombie Stems Bleeding Sales in Key Brand A Pristine Trading Plan for Intra-Day TradingSaturday, July 12, 2014Vacation like a star, paparazzi included $2,500 to live like a celebrity for a day NEW YORK (CNNMoney) Minibars, room service, and spa days are nice treats for hotel guests, but how about living the life of a superstar for a day? $2,500 to live like a celebrity for a day NEW YORK (CNNMoney) Minibars, room service, and spa days are nice treats for hotel guests, but how about living the life of a superstar for a day? Some upscale hotels are offering creative packages where guests can bask in the glow of the paparazzi, spend a weekend like a famed secret agent, or recreate the experience of a heroine in a romantic comedy. At Row NYC, for example, guests can pay $2,500 for a taste of the glamorous world of a celebrity. The hotel's Paparazzi Project package includes one night's stay at the hotel's penthouse suite (named and inspired by famed photographer Ron Galella); hair and make-up done by a team led by a celebrity stylist; and a personal paparazzo to shoot the experience. The paparazzo, from agency Getty Images, can catalog the guest's celebrity transformation, follow the guest through the hotel, and snap photos of them around Times Square. "Everyone sees you're being treated like [a celebrity]," said Elizabeth Wilson, a 23-year-old from Kansas City who received the package as a graduation gift from her parents.

Those looking for a little more mystery can head to Scotland for a James Bond escape. Over the course of a $2,100 weekend, guests at the Isle of Eriska Hotel, Spa & Island can drive an Aston Martin through the Scottish Highlands to Glencoe, where scenes of Skyfall were shot, and learn how to make the ultimate martini -- shaken not stirred. They can also ride a speedboat like 007 and tour locations where scenes from The Spy Who Loved Me, From Russia With Love, and other Bond classics were filmed.

Meanwhile, the Beverly Wilshire in Beverly Hills offers a chance to step into the role that made Julia Roberts a household name. The hotel's package, starting at $15,000, gives guests the opportunity to be Pretty Woman for a day. Highlights include a stay in the same suite as Roberts' character and a styling trip with a personal shopper along Rodeo Drive for two hours. For those willing to spend upwards of $100,000, the ultimate package includes a picnic, musical serenade, and special guest appearance by celebrity chef Wolfgang Puck.

Friday, July 11, 2014

|

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

73.52 (1y: +45%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BOFI',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373605200000,50.85],[1373864400000,52.03],[1373950800000,50.78],[1374037200000,50.58],[1374123600000,50.3],[1374210000000,51.39],[1374469200000,50.63],[1374555600000,51.37],[1374642000000,52.7],[1374728400000,53.02],[1374814800000,53.89],[1375074000000,54.3],[1375160400000,53.8],[1375246800000,54.25],[1375333200000,55.99],[1375419600000,57.03],[1375678800000,57.99],[1375765200000,58.26],[1375851600000,61.48],[1375938000000,65.19],[1376024400000,67],[1376283600000,65.56],[1376370000000,68.82],[1376456400000,68.12],[1376542800000,65.8],[1376629200000,67.46],[1376888400000,66.24],[1376974800000,65.85],[1377061200000,63.82],[1377147600000,66.3],[1377234000000,66.35],[1377493200000,65.42],[1377579600000,62.26],[1377666000000,64.24],[1377752400000,64.64],[1377838800000,64.77],[1378184400000,64.56],[1378270800000,64.65],[1378357200000,63.18],[1378443600000,62.92],[1378702800000,60.67],[1378789200000,63.5],[1378875600000,64.24],[1378962000000,63.54],[1379048400000,64.06],[1379307600000,63.25],[1379394000000,66.95],[1379480400000,66.99],[1379566800000,66.37],[1379653200000,66.6],[1379912400000,64.43],[1379998800000,65.03],[1380085200000,64.84],[1380171600000,65.54],[1380258000000,64.72],[1380517200000,64.812],[1380603600000,65.9],[1380690000000,64.77],[1380776400000,64.59],[1380862800000,65.13],[1381122000000,64.53],[1381208400000,61.55],[1381294800000,63.48],[1381381200000,65.19],[1381467600000,65.92],[1381726800000,68],[1381813200000,67.83],[1381899600000,69.7],[1381986000000,69.76],[1382072400000,70.53],[1382331600000,70.35],[1382418000000,67.87],[1382504400000,64.56],[1382590800000,66.45],[1382677200000,66.51],[1382936400000,66.54],[1383022800000,66.6],[1383109200000,59.04],[1383195600000,60.42],[1383282000000,60.06],[1383544800000,61.27],[1383631200000,68.98],[1383717600000,67.29],[1383804000000,65.04],[1383890400000,68.03],[1384149600000,66.65],[1384236000000,68.35],[1384322400! 000,69.13],[1384408800000,72.14],[1384495200000,74.85],[1384754400000,73.94],[1384840800000,73],[1384927200000,73.21],[1385013600000,75.29],[1385100000000,76.48],[1385359200000,75.68],[1385445600000,76.93],[1385532000000,80.44],[1385704800000,81.96],[1385964000000,79.84],[1386050400000,79.45],[1386136800000,80.27],[1386223200000,80.02],[1386309600000,79.54],[1386568800000,78.95],[1386655200000,79.235],[1386741600000,77.1],[1386828000000,77.58],[1386914400000,78.61],[1387173600000,79.5],[1387260000000,78.99],[1387346400000,79.99],[1387432800000,78.85],[1387519200000,78.58],[1387778400000,80.06],[1387864800000,79.93],[1388037600000,79.14],[1388124000000,78.26],[1388383200000,77.35],[1388469600000,78.43],[1388642400000,75.95],[1388728800000,75.94],[1388988000000,75.57],[1389074400000,75.58],[1389160800000,78.35],[1389247200000,80.4],[1389333600000,78.8],[1389592800000,77.67],[1389679200000,78.92],[1389765600000,79.57],[1389852000000,78.98],[1389938400000,80.22],[1390284000000,80.61],[1390370400000,81.06],[1390456800000,80.66],[1390543200000,79.8],[1390802400000,79.73],[1390888800000,80.68],[1390975200000,79.97],[1391061600000,82.68],[1391148000000,82.75],[1391407200000,77.42],[1391493600000,76.12],[1391580000000,76.27],[1391666400000,78.33],[1391752800000,80.13],[1392012000000,80.24],[1392098400000,80.67],[1392184800000,81.33],[1392271200000,82.5],[1392357600000,83.2],[1392703200000,86.8],[1392789600000,85.08],[1392876000000,86.62],[1392962400000,86.38],[1393221600000,89.05],[1393308000000,89.95],[1393394400000,94.09],[1393480800000,94.42],[1393567200000,93.1],[1393826400000,91.33],[1393912800000,98.225],[1393999200000,99.53],[1394085600000,102.14],[1394172000000,101.35],[1394427600000,101.08],[1394514000000,101.52],[1394600400000,104.2],[1394686800000,100.44],[1394773200000,105.55],[1395032400000,102.72],[1395118800000,101.51],[1395205200000,92.86],[1395291600000,89.83],[1395378000000,86.44],[1395637200000,85.76],[1395723600000,83.38],[1395810000000,78.47],[1395896400000,76.84],[1395982800000,87.9],[13962! 42000000,! 85.75],[1396328400000,85.75],[1396414800000,84.09],[1396501200000,81.66],[1396587600000,80],[1396846800000,73.44],[1396933200000,77.98],[1397019600000,76.71],[1397106000000,74.44],[1397192400000,80.46],[1397451600000,80.85],[1397538000000,80.16],[1397624400000,81.26],[1397710800000,85.3],[1398056400000,85.12],[1398142800000,85.72],[1398229200000,85],[1398315600000,83.88],[1398402000000,80.34],[1398661200000,79.4],[1398747600000,79.28],[1398834000000,80.61],[1398920400000,81.48],[1399006800000,82.25],[1399266000000,80.26],[1399352400000,83.02],[1399438800000,81.98],[1399525200000,79.96],[1399611600000,79.71],[1399870800000,81.59],[1399957200000,80.81],[1400043600000,77.25],[1400130000000,75.91],[1400216400000,75.25],[1400475600000,76.24],[1400562000000,76.77],[1400648400000,76.09],[1400734800000,77.63],[1400821200000,79],[1401166800000,80.43],[1401253200000,78.46],[1401339600000,78.45],[1401426000000,76.83],[1401685200000,76.48],[1401771600000,78.16],[1401858000000,78.25],[1401944400000,79.44],[1402030800000,79.83],[1402290000000,79.62],[1402376400000,78.13],[1402462800000,77.36],[1402549200000,76.46],[1402635600000,75.65],[1402894800000,77.59],[1402981200000,77.09],[1403067600000,74.63],[1403154000000,72.41],[1403240400000,74.65],[1403499600000,73.06],[1403586000000,73.16],[1403672400000,73.75],[1403758800000,74.18],[1403845200000,75.05],[1404190800000,75.91],[1404277200000,75.51],[1404363600000,75.04],[1404709200000,74.06],[1404795600000,72.77],[1404882000000,75.32],[1405114965000,73.52],[1405114965000,73.52],[1405073458000,73.52]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,value){value.setState(0);}

73.52 (1y: +45%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BOFI',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373605200000,50.85],[1373864400000,52.03],[1373950800000,50.78],[1374037200000,50.58],[1374123600000,50.3],[1374210000000,51.39],[1374469200000,50.63],[1374555600000,51.37],[1374642000000,52.7],[1374728400000,53.02],[1374814800000,53.89],[1375074000000,54.3],[1375160400000,53.8],[1375246800000,54.25],[1375333200000,55.99],[1375419600000,57.03],[1375678800000,57.99],[1375765200000,58.26],[1375851600000,61.48],[1375938000000,65.19],[1376024400000,67],[1376283600000,65.56],[1376370000000,68.82],[1376456400000,68.12],[1376542800000,65.8],[1376629200000,67.46],[1376888400000,66.24],[1376974800000,65.85],[1377061200000,63.82],[1377147600000,66.3],[1377234000000,66.35],[1377493200000,65.42],[1377579600000,62.26],[1377666000000,64.24],[1377752400000,64.64],[1377838800000,64.77],[1378184400000,64.56],[1378270800000,64.65],[1378357200000,63.18],[1378443600000,62.92],[1378702800000,60.67],[1378789200000,63.5],[1378875600000,64.24],[1378962000000,63.54],[1379048400000,64.06],[1379307600000,63.25],[1379394000000,66.95],[1379480400000,66.99],[1379566800000,66.37],[1379653200000,66.6],[1379912400000,64.43],[1379998800000,65.03],[1380085200000,64.84],[1380171600000,65.54],[1380258000000,64.72],[1380517200000,64.812],[1380603600000,65.9],[1380690000000,64.77],[1380776400000,64.59],[1380862800000,65.13],[1381122000000,64.53],[1381208400000,61.55],[1381294800000,63.48],[1381381200000,65.19],[1381467600000,65.92],[1381726800000,68],[1381813200000,67.83],[1381899600000,69.7],[1381986000000,69.76],[1382072400000,70.53],[1382331600000,70.35],[1382418000000,67.87],[1382504400000,64.56],[1382590800000,66.45],[1382677200000,66.51],[1382936400000,66.54],[1383022800000,66.6],[1383109200000,59.04],[1383195600000,60.42],[1383282000000,60.06],[1383544800000,61.27],[1383631200000,68.98],[1383717600000,67.29],[1383804000000,65.04],[1383890400000,68.03],[1384149600000,66.65],[1384236000000,68.35],[1384322400! 000,69.13],[1384408800000,72.14],[1384495200000,74.85],[1384754400000,73.94],[1384840800000,73],[1384927200000,73.21],[1385013600000,75.29],[1385100000000,76.48],[1385359200000,75.68],[1385445600000,76.93],[1385532000000,80.44],[1385704800000,81.96],[1385964000000,79.84],[1386050400000,79.45],[1386136800000,80.27],[1386223200000,80.02],[1386309600000,79.54],[1386568800000,78.95],[1386655200000,79.235],[1386741600000,77.1],[1386828000000,77.58],[1386914400000,78.61],[1387173600000,79.5],[1387260000000,78.99],[1387346400000,79.99],[1387432800000,78.85],[1387519200000,78.58],[1387778400000,80.06],[1387864800000,79.93],[1388037600000,79.14],[1388124000000,78.26],[1388383200000,77.35],[1388469600000,78.43],[1388642400000,75.95],[1388728800000,75.94],[1388988000000,75.57],[1389074400000,75.58],[1389160800000,78.35],[1389247200000,80.4],[1389333600000,78.8],[1389592800000,77.67],[1389679200000,78.92],[1389765600000,79.57],[1389852000000,78.98],[1389938400000,80.22],[1390284000000,80.61],[1390370400000,81.06],[1390456800000,80.66],[1390543200000,79.8],[1390802400000,79.73],[1390888800000,80.68],[1390975200000,79.97],[1391061600000,82.68],[1391148000000,82.75],[1391407200000,77.42],[1391493600000,76.12],[1391580000000,76.27],[1391666400000,78.33],[1391752800000,80.13],[1392012000000,80.24],[1392098400000,80.67],[1392184800000,81.33],[1392271200000,82.5],[1392357600000,83.2],[1392703200000,86.8],[1392789600000,85.08],[1392876000000,86.62],[1392962400000,86.38],[1393221600000,89.05],[1393308000000,89.95],[1393394400000,94.09],[1393480800000,94.42],[1393567200000,93.1],[1393826400000,91.33],[1393912800000,98.225],[1393999200000,99.53],[1394085600000,102.14],[1394172000000,101.35],[1394427600000,101.08],[1394514000000,101.52],[1394600400000,104.2],[1394686800000,100.44],[1394773200000,105.55],[1395032400000,102.72],[1395118800000,101.51],[1395205200000,92.86],[1395291600000,89.83],[1395378000000,86.44],[1395637200000,85.76],[1395723600000,83.38],[1395810000000,78.47],[1395896400000,76.84],[1395982800000,87.9],[13962! 42000000,! 85.75],[1396328400000,85.75],[1396414800000,84.09],[1396501200000,81.66],[1396587600000,80],[1396846800000,73.44],[1396933200000,77.98],[1397019600000,76.71],[1397106000000,74.44],[1397192400000,80.46],[1397451600000,80.85],[1397538000000,80.16],[1397624400000,81.26],[1397710800000,85.3],[1398056400000,85.12],[1398142800000,85.72],[1398229200000,85],[1398315600000,83.88],[1398402000000,80.34],[1398661200000,79.4],[1398747600000,79.28],[1398834000000,80.61],[1398920400000,81.48],[1399006800000,82.25],[1399266000000,80.26],[1399352400000,83.02],[1399438800000,81.98],[1399525200000,79.96],[1399611600000,79.71],[1399870800000,81.59],[1399957200000,80.81],[1400043600000,77.25],[1400130000000,75.91],[1400216400000,75.25],[1400475600000,76.24],[1400562000000,76.77],[1400648400000,76.09],[1400734800000,77.63],[1400821200000,79],[1401166800000,80.43],[1401253200000,78.46],[1401339600000,78.45],[1401426000000,76.83],[1401685200000,76.48],[1401771600000,78.16],[1401858000000,78.25],[1401944400000,79.44],[1402030800000,79.83],[1402290000000,79.62],[1402376400000,78.13],[1402462800000,77.36],[1402549200000,76.46],[1402635600000,75.65],[1402894800000,77.59],[1402981200000,77.09],[1403067600000,74.63],[1403154000000,72.41],[1403240400000,74.65],[1403499600000,73.06],[1403586000000,73.16],[1403672400000,73.75],[1403758800000,74.18],[1403845200000,75.05],[1404190800000,75.91],[1404277200000,75.51],[1404363600000,75.04],[1404709200000,74.06],[1404795600000,72.77],[1404882000000,75.32],[1405114965000,73.52],[1405114965000,73.52],[1405073458000,73.52]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,value){value.setState(0);}

Why Lumber Liquidators Disastrous Quarter is Bad News for Home Depot, Lowe’s

Lumber Liquidators (LL) found it a lot harder to liquidate its lumber during the second quarter–and its weakness is hitting shares of Home Depot (HD) and Lowe’s (LOW) today as well.

Bloomberg News

Bloomberg News The reason: Lumber Liquidators said that second quarter earnings would come in between 59 cents and 61 cents a share, well below forecasts for 90 cents, as same-store sales fell 7.1%.

Raymond James’ Budd Bugatch and team are “waiting for the dust to settle” at Lumber Liquidators:

We felt like management spent its call trying to rationalize reasons for the weaker than expected results. After all, on its 1Q call, management exuded confidence that 1Q's results were totally weather related and that early order indications heading into the April sale gave it belief that consumers were ready to get back to work on delayed projects. As such, it left FY14 guidance intact. Now, management hypothesizes that the strong early 2Q orders and sales were, in fact, pent-up demand; but that the purchase cycle was interrupted by the bad weather. We are not convinced. While we are very respectful of the Lumber Liquidators business model (excellent operating and capital returns); it is a big-ticket business with attendant volatility. Management noted that the difference in 2Q sales between stores weather-affected (131) and those not (206) was "~1 transaction per store every other day." So, despite the attraction of the model, there are times when results can and will be different than expected, making it a challenging public equity. To us, this reinforces our value bias to buying and owning Lumber Liquidators…

For now, we are keeping our Underperform rating on Lumber Liquidators intact, waiting for the dust to settle after management's 2Q14 business update press release and late afternoon conference call.

Deutsche Bank’s Mike Baker and Adam Sindler see tougher times ahead for Home Depot and Lowe’s following the bad news from Lumber Liquidators and Tractor Supply (TSCO):

Despite major differences between Home Depot/Lowe’s and these two retailers including product categories and the timing of the quarters, both Tractor Supply and Lumber Liquidators have historically correlated positively with Home Depot and Lowe’s on comps. Lumber Liquidators and the home centers have exposure to housing markets, which have not been as strong in 2014 versus last year, and Tractor Supply and the home centers have exposure to the outdoor / weather sensitive business. Hence, we think it's prudent to lower numbers. That said, due to the differences in the business models, we think comps are probably holding up better at Home Depot and Lowe’s, and so our reductions are relatively minor. We maintain our Buy rating on Lowe’s and Hold on Home Depot.

Baker and Sindler lowered their second-quarter earnings forecast on Lowe’s to $1.02 from $1.03, and on Home Depot to $1.44 from $1.45.

Shares of Lumber Liquidators have plunged 22% to $54.78, while Tractor Supply has fallen 2.3% to $59.99, Home Depot has declined1.6% to $79.47 and Lowe’s has dropped 1.1% to $47.31.

Thursday, July 10, 2014

Emerge, Phillips 66 Lead Strong MLP Gains

The first half of 2014 is in the books, and it was a good one for publicly traded Master Limited Partnerships (MLPs), and for the energy sector overall. The Standard & Poor’s 500 Energy index rose 12 percent in the first half, compared to a 7 percent rise for the S&P 500. Most of the gains in the energy sector took place in the second quarter, with the S&P 500 Energy index up 11 percent, more than double the nearly 5 percent gain for the S&P 500.

But MLPs outperformed the S&P 500 and even the broader energy market rally. The Alerian MLP Index gained 13.6 percent in the first half, with a total return (factoring in yield) of 16.8 percent. As with the broader energy markets, the gains occurred mostly in the second quarter, which delivered a total return of 14.2 percent.

There were six initial public offerings (IPOs) of MLPs in the first half of the year. They were:

Cypress Energy Partners (NYSE: CELP), a growth-oriented MLP providing saltwater disposal and other water and environmental services to US onshore oil and natural gas producers in North Dakota and west Texas

Enable Midstream Partners (NYSE: ENBL), a joint venture by affiliates of CenterPoint Energy (NYSE: CNP), OGE Energy (NYSE: OGE) and ArcLight Capital Partners. Enable Midstream Partners is one of the largest midstream partnerships in the US, with oil and gas midstream assets that extend from western Oklahoma and the Texas Panhandle to Alabama and from Louisiana to Illinois

GasLog Partners (NYSE: GLOP), an offshoot of GasLog (NYSE: GLOG). GasLog Partners owns three liquefied natural gas (LNG) carriers dropped down from GLOG, and has options to purchase 12 more

PBF Logistics (NYSE: PBFX), a midstream company formed by PBF Energy (NYSE: PBF) that will serve as the primary vehicle to expand the logistics assets supporting its business. The partnership currently supports crude oil logistics f! or three PBF Energy refineries and will own or lease, operate, develop and acquire crude oil and refined petroleum products terminals, pipelines, storage facilities and similar logistics assets

Foresight Energy Partners (NYSE: FELP), a coal producer operating four underground mining complexes in the Illinois Basin. FELP is one of the largest owners of coal reserves in the US, and claims to be the lowest cost and highest margin domestic thermal coal producer

Viper Energy Partners (NASDAQ: VNOM), a spinoff from Diamondback Energy (NASDAQ: FANG). Viper owns mineral rights on 14,804 acres in the Permian Basin in West Texas, and became the first US-listed partnership structured on the basis of royalty payments

In addition to the MLP IPOs, momentum continued to build for the financial instrument known as a YieldCo. (See YieldCos: The Pseudo-MLP.) Spanish power plant builder Abengoa (NASDAQ: ABGB) formed Abengoa Yield (NASDAQ: ABY) to own two concentrating solar power plants in the US, two smaller ones in Spain, and a handful of other assets (a mix of renewable and nonrenewable).

Another YieldCo, Nextera Energy Partners (NYSE: NEP) which will own and operate renewable energy plants built by NextEra Energy (NYSE: NEE) launched June 27. NEP priced its IPO at $25 per share, then saw the share price surge to $32.36 on the first day of trading. NEP's initial portfolio will consist of wind and solar farms in the US and Canada with a total generating capacity just under a gigawatt.

Another milestone in the first half of 2014 came when the first major integrated oil and gas company made plans to launch an MLP. According to the S-1 registration statement with the Securities and Exchange Commission (SEC), Shell Midstream Partners (which will trade as SHLX) plans to raise up to $750 million in the IPO for sponsor Royal Dutch Shell (NYSE: RDS-A). Assets included in the IPO are a 1.6 percent interest in Colonial Pipeline Company, which owns the largest refined products pipel! ine in th! e US; a 43 percent interest in Zydeco Pipeline Company, which will own the Ho-Ho crude oil pipeline system; a 28.6 percent interest in Mars Oil Pipeline Company, which owns the Mars crude oil pipeline; and a 49 percent interest in Bengal Pipeline Company, which owns a refined products pipeline that connects four refineries in Louisiana.

The top performing MLP of the first half was Emerge Energy Services (NYSE: EMES), a supplier of sand used in hydraulic fracking (+146 percent). The second leading gainer with a gain of 110 percent was Phillips 66 Partners (NYSE: PSXP), which IPO'd a year ago and consists of midstream assets dropped down from its sponsor, Phillips 66 (NYSE: PSX).

Rounding out the top five were Hi-Crush Partners (NYSE: HCLP), another supplier of fracking sand (+71 percent), EQT Midstream Partners (NYSE: EQM), a midstream provider in the Appalachian Basin (+66.5 percent), and Valero Energy Partners (NYSE:VLP) (+61.5 percent), which consists of midstream assets dropped down from the refiner Valero Energy (NYSE:VLO).

The worst performer in the first half was Oxford Resource Partners (NYSE: OXF), a coal producer that suspended its distribution more than a year ago and has seen its unit price continue to decline. It is down 31.5 percent in 2014. Boardwalk Pipeline Partners (NYSE: BWP) saw the second worst decline in the first half of 2014 after announcing a distribution cut of more than 80 percent. BWP saw its unit price plunge by 46 percent in a single trading session. It has since recovered somewhat, but is down 28.8 percent year-to-date.

Rounding out the bottom five were OCI Partners (NYSE: OCIP), a methanol and ammonia producer (-24 percent YTD), Natural Resource Partners (NYSE: NRP), another coal producer (-19 percent), and Eagle Rock Energy Partners (NASDAQ: EROC), an oil and gas production partnership (-17 percent).

(Follow Robert Rapier on Twitter, LinkedIn, or Facebook.)

Wednesday, July 9, 2014

Why Dividends Matter

Over the last several years Dividend Stocks have become immensely popular. It seems that every financial adviser or financial publication is proclaiming that you should own dividend stocks. Each are singing the virtues of dividend stocks from their own perspective. To that I have two questions:

1. What took you so long? 2. Do you really understand why dividend stocks are such a good long-term investment? I am entertained that many "experts" are now recommending dividend stocks based on his or her investing makeup. Some are recommending dividend stocks as part of their sector rotation, or as the next hot fad, - stay tuned and they will tell you when to jump out. Others are recommending dividend stocks as substitutes for bonds since yields on fixed income investments have all but dried up. All arrived at what I consider to be the correct conclusion, but do they really understand why dividends matter? Below are 11 reasons why dividends matter in all markets:

1. In a troubled market, dividends provide investment opportunityWhile everyone else is panicked about their portfolio's decline, dividend investors see a downturn as an incredible buying opportunity. The lower a stock's price goes the higher its dividend yield. In a down-market it is a lot easier to buy a stock that pays you an increasing dividend than one that doesn't. Simply put, the dividend stock is paying you to wait on its recovery, while the non-payer may continue to decline of remain stagnate for years.

2. Unlike earnings, dividends can't be manipulated or fakedFrom an accounting standpoint, it is relatively easy through fraud and manipulation to make an income statement look quite impressive. There is no faking the cash that shows up in your brokerage account. Companies with long histories of dividend increases are less likely to take extreme risks that could potentially jeopardize their streak.

3. Dividends provide continuous feedbackAs time passes dividend investors see their income steadily grow. You do not have to wait five to ten years to determine if the strategy is working. Each dividend and dividend increase provides the investor with reassurance that the strategy is working.This reassurance helps investors to the right thing in troubled markets.

4. Reinvested dividends provided a significant portion of the historical equity returnsPerformance in any given year is driven by capital appreciation, but long-term returns are largely the result of reinvested dividends. John Bogle, the founder and retired CEO of The Vanguard Group, once wrote: "An investment of $10,000 in the S&P 500 Index at its 1926 inception with all dividends reinvested would by the end of September 2007 have grown to approximately $33,100,000 (10.4% compounded). If dividends had not been reinvested, the value of that investment would have been just over $1,200,000 (6.1% compounded) – an amazing gap of $32 million. Over the past 81 years, then, reinvested dividend income accounted for approximately 95% of the compound long-term return earned by the companies in the S&P 500."

5. Good dividend companies grow their dividendsYou expect your employer to give you a raise periodically. Why wouldn't you expect the same from your investments? Healthy companies are growing earnings and share price, thus to pay a competitive yield the company must also grow its dividend.

6. Spending dividends in retirement, does not harm your principle investmentStock prices do not move in a straight line. There are protracted periods were the market moves down. Having to sell more shares in a down market to cover rising expenses, will have a long-term negative effect on your wealth even after the market recovers. In addition, a good dividend portfolio can be left to your children and their children.

7. A dividend portfolio is relatively low maintenanceYou may not want to spend your retirement managing and worrying about your portfolio. Careful selection of quality blue-chip Dividend Growth Stocks will provide you a lifetime of growing earnings with very little maintenance needed.

8. Dividends help identify well-managed companiesCompanies that grow their dividend on a regular basis tend to be those in better off financially and are able to sustain earnings growth. I(t is no accident that some of the very best companies have been growing their dividends for 30, 40, 50 or more years.

9. Dividend-paying stocks provide a built-in returnCompanies that pay a sustainable and growing dividends, are more resilient in down markets. Investors in Dividend Growth Stocks aggressively buy in downturns, which provides support to the stock's price. In the up markets investors enjoy capital appreciation as earnings grow to support the increasing dividend.

10. Dividend Growth Stocks are an inflation hedgeEagle Asset Management, in an April 2010 whitepaper noted, "Dividend-paying equities historically have generated income that has kept pace with inflation, an important factor for many investors." Inflation is inevitable. If our income isn't growing, then we are falling behind and our buying power is being eroded.

11. Qualified dividends are taxed at a lower rateStarting in 2013 the federal tax rates on qualified dividends are 0%, 15% and 20%. The 20% rate is for taxpayers in the 39.6% tax bracket. For those in the 10% and 15% brackets, there is no tax on qualified dividends. In contrast, ordinary income is taxed at rates up to up to 39.6%. Below are several stocks that have consistently paid dividends through depressions, recessions, world wars, and other political and economic upheavals:WGL Holdings Inc. (WGL) provides natural gas service in the Washington, DC, metropolitan area and surrounding regions, including Maryland and Virginia. Yield: 4.1% | Paid Dividends Since: 1852Exxon Mobil Corp. (XOM), formed through the merger of Exxon and Mobil in late 1999, is the world's largest publicly owned integrated oil company. Yield: 2.7% | Paid Dividends Since: 1882Consolidated Edison, Inc. (ED) is an electric and gas utility holding company serves parts of New York, New Jersey and Pennsylvania. Yield: 4.4% | Paid Dividends Since: 1885The Procter & Gamble Company (PG) is a leading consumer products company that markets household and personal care products in more than 180 countries. Yield: 3.2% | Paid Dividends Since: 1891The Coca-Cola Company (KO) is the world's largest soft drink company, KO also has a sizable fruit juice business. Yield: 2.9% | Paid Dividends Since: 1893General Mills, Inc. (GIS) is a major producer of packaged consumer food products, include cereal, yogurt and Betty Crocker desserts/baking mixes. Yield: 3.0% | Paid Dividends Since: 1898Avista Corp. (AVA) generates, transmits and distributes energy as well as engages in energy-related businesses in the United States and Canada. Yield: 3.0% | Paid Dividends Since: 1899MGE Energy Inc. (MGEE) is a public utility holding company that supplies electric service to apx. 140,000 customers; and natural gas service to apx. 145,000 customers in Wisconsin (as of December 2012). Yield: 2.8% | Paid Dividends Since: 1909Xcel Energy Inc. (XEL) offers energy-related products and services to 3.4 million electricity customers and 1.9 million natural gas customers in eight western and midwestern states. Yield: 3.8% | Paid Dividends Since: 1910Middlesex Water Co. (MSEX) primarily provides regulated water utility service in parts of New Jersey and Delaware, as well as operates wastewater systems and conducts municipal contract operations. Yield: 3.9% | Paid Dividends Since: 1912Chevron Corporation (CVX) is a global integrated oil company (formerly ChevronTexaco) has interests in exploration, production, refining and marketing, and petrochemicals. Yield: 3.2% | Paid Dividends Since: 1912 Try telling these companies that dividends don't matter and see what kind or reaction you get. Or more importantly, try telling these companies' shareholders that dividends don't matter. A healthy and wealthy retirement comes from building a secure portfolio, not watching for the next fad.Full Disclosure: Long XOM, ED, PG, KO, CVX in my Dividend Growth Portfolio and long AVA in my High-Yield Portfolio. See a list of all my dividend growth holdings here.Related Articles - 9 High-Rated Dividend Stocks With Above Target Returns - 9 High-Yielding Utilities With A Growing Dividends - My 5 Largest Dividend Stock Positions Have Double-Digit Lifetime Returns - The Best Dividend Stocks In The World - 12 Dividend Stocks With 50+ Years of Consecutive Increases

About the author:Dividends4LifeVisit Dividends4Life at: http://www.dividend-growth-stocks.com/| Currently 5.00/512345 Rating: 5.0/5 (1 vote) | Voters: |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

41.54 (1y: -4%) $(function(){var seriesOptions=[],yAxisOptions=[],name='WGL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373432400000,43.16],[1373518800000,43.44],[1373605200000,43.64],[1373864400000,44.43],[1373950800000,44.32],[1374037200000,44.65],[1374123600000,45.07],[1374210000000,45.67],[1374469200000,45.96],[1374555600000,46.1],[1374642000000,45.2],[1374728400000,46.16],[1374814800000,46.15],[1375074000000,46.25],[1375160400000,46.04],[1375246800000,45.97],[1375333200000,46.8],[1375419600000,46.25],[1375678800000,46.18],[1375765200000,45.84],[1375851600000,45.62],[1375938000000,45.52],[1376024400000,45.56],[1376283600000,45.59],[1376370000000,45.16],[1376456400000,44.68],[1376542800000,43.65],[1376629200000,43.34],[1376888400000,43.12],[1376974800000,43.63],[1377061200000,42.97],[1377147600000,43.26],[1377234000000,43.45],[1377493200000,43.24],[1377579600000,42.68],[1377666000000,42.72],[1377752400000,42.62],[1377838800000,41.74],[1378184400000,40.65],[1378270800000,40.53],[1378357200000,40.09],[1378443600000,40.32],[1378702800000,40.54],[1378789200000,40.81],[1378875600000,40.68],[1378962000000,40.62],[1379048400000,41.09],[1379307600000,40.87],[1379394000000,41.23],[1379480400000,42.2],[1379566800000,42.09],[1379653200000,41.66],[1379912400000,42.56],[1379998800000,42.86],[1380085200000,42.9],[1380171600000,42.91],[1380258000000,42.6],[1380517200000,42.71],[1380603600000,42.88],[1380690000000,42.73],[1380776400000,41.78],[1380862800000,41.85],[1381122000000,41.67],[1381208400000,41.54],[1381294800000,41.49],[1381381200000,42.09],[1381467600000,42.42],[1381726800000,42.45],[1381813200000,41.81],[1381899600000,42.36],[1381986000000,43.39],[1382072400000,43.78],[1382331600000,43.83],[1382418000000,44.29],[1382504400000,44.88],[1382590800000,44.81],[1382677200000,45.27],[1382936400000,45.37],[1383022800000,45.4],[1383109200000,45.05],[1383195600000,45.01],[1383282000000,45.18],[1383544800000,45.39],[1383631200000,45.01],[1383717600000,45.3],[1383804000000,44.69],[1383890400000,44.83],[13! 84149600000,44.9],[1384236000000,44.24],[1384322400000,44.84],[1384408800000,40.81],[1384495200000,39.5],[1384754400000,39.5],[1384840800000,40.58],[1384927200000,40.33],[1385013600000,40.44],[1385100000000,40.22],[1385359200000,40],[1385445600000,39.86],[1385532000000,39.73],[1385704800000,39.85],[1385964000000,39.2],[1386050400000,39.38],[1386136800000,39.01],[1386223200000,38.83],[1386309600000,39.82],[1386568800000,39.46],[1386655200000,38.91],[1386741600000,38.63],[1386828000000,38.68],[1386914400000,38.79],[1387173600000,38.84],[1387260000000,38.74],[1387346400000,38.7],[1387432800000,38.2],[1387519200000,39.36],[1387778400000,39.26],[1387864800000,39.36],[1388037600000,39.21],[1388124000000,39.45],[1388383200000,39.53],[1388469600000,40.06],[1388642400000,39.61],[1388728800000,39.57],[1388988000000,39.31],[1389074400000,39.72],[1389160800000,38.91],[1389247200000,38.84],[1389333600000,38.89],[1389592800000,38.35],[1389679200000,38.63],[1389765600000,38.4],[1389852000000,38.58],[1389938400000,38.36],[1390284000000,38.95],[1390370400000,38.99],[1390456800000,38.88],[1390543200000,38.44],[1390802400000,38.07],[1390888800000,37.86],[1390975200000,37.55],[1391061600000,38.2

41.54 (1y: -4%) $(function(){var seriesOptions=[],yAxisOptions=[],name='WGL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373432400000,43.16],[1373518800000,43.44],[1373605200000,43.64],[1373864400000,44.43],[1373950800000,44.32],[1374037200000,44.65],[1374123600000,45.07],[1374210000000,45.67],[1374469200000,45.96],[1374555600000,46.1],[1374642000000,45.2],[1374728400000,46.16],[1374814800000,46.15],[1375074000000,46.25],[1375160400000,46.04],[1375246800000,45.97],[1375333200000,46.8],[1375419600000,46.25],[1375678800000,46.18],[1375765200000,45.84],[1375851600000,45.62],[1375938000000,45.52],[1376024400000,45.56],[1376283600000,45.59],[1376370000000,45.16],[1376456400000,44.68],[1376542800000,43.65],[1376629200000,43.34],[1376888400000,43.12],[1376974800000,43.63],[1377061200000,42.97],[1377147600000,43.26],[1377234000000,43.45],[1377493200000,43.24],[1377579600000,42.68],[1377666000000,42.72],[1377752400000,42.62],[1377838800000,41.74],[1378184400000,40.65],[1378270800000,40.53],[1378357200000,40.09],[1378443600000,40.32],[1378702800000,40.54],[1378789200000,40.81],[1378875600000,40.68],[1378962000000,40.62],[1379048400000,41.09],[1379307600000,40.87],[1379394000000,41.23],[1379480400000,42.2],[1379566800000,42.09],[1379653200000,41.66],[1379912400000,42.56],[1379998800000,42.86],[1380085200000,42.9],[1380171600000,42.91],[1380258000000,42.6],[1380517200000,42.71],[1380603600000,42.88],[1380690000000,42.73],[1380776400000,41.78],[1380862800000,41.85],[1381122000000,41.67],[1381208400000,41.54],[1381294800000,41.49],[1381381200000,42.09],[1381467600000,42.42],[1381726800000,42.45],[1381813200000,41.81],[1381899600000,42.36],[1381986000000,43.39],[1382072400000,43.78],[1382331600000,43.83],[1382418000000,44.29],[1382504400000,44.88],[1382590800000,44.81],[1382677200000,45.27],[1382936400000,45.37],[1383022800000,45.4],[1383109200000,45.05],[1383195600000,45.01],[1383282000000,45.18],[1383544800000,45.39],[1383631200000,45.01],[1383717600000,45.3],[1383804000000,44.69],[1383890400000,44.83],[13! 84149600000,44.9],[1384236000000,44.24],[1384322400000,44.84],[1384408800000,40.81],[1384495200000,39.5],[1384754400000,39.5],[1384840800000,40.58],[1384927200000,40.33],[1385013600000,40.44],[1385100000000,40.22],[1385359200000,40],[1385445600000,39.86],[1385532000000,39.73],[1385704800000,39.85],[1385964000000,39.2],[1386050400000,39.38],[1386136800000,39.01],[1386223200000,38.83],[1386309600000,39.82],[1386568800000,39.46],[1386655200000,38.91],[1386741600000,38.63],[1386828000000,38.68],[1386914400000,38.79],[1387173600000,38.84],[1387260000000,38.74],[1387346400000,38.7],[1387432800000,38.2],[1387519200000,39.36],[1387778400000,39.26],[1387864800000,39.36],[1388037600000,39.21],[1388124000000,39.45],[1388383200000,39.53],[1388469600000,40.06],[1388642400000,39.61],[1388728800000,39.57],[1388988000000,39.31],[1389074400000,39.72],[1389160800000,38.91],[1389247200000,38.84],[1389333600000,38.89],[1389592800000,38.35],[1389679200000,38.63],[1389765600000,38.4],[1389852000000,38.58],[1389938400000,38.36],[1390284000000,38.95],[1390370400000,38.99],[1390456800000,38.88],[1390543200000,38.44],[1390802400000,38.07],[1390888800000,37.86],[1390975200000,37.55],[1391061600000,38.2

Tuesday, July 8, 2014

5 Stocks Set to Soar on Bullish Earnings

DELAFIELD, Wis. (Stockpickr) -- Short-sellers hate being caught short a stock that reports a blowout quarter. When this happens, we often see a tradable short squeeze develop as the bears rush to cover their positions to avoid big losses. Even the best short-sellers know that it's never a great idea to stay short once a bullish earnings report sparks a big short-covering rally.

>>5 Tech Stocks to Trade for Gains This Week

This is why I scan the market for heavily shorted stocks that are about to report earnings. You only need to find a few of these stocks in a year to help enhance your portfolio returns -- the gains become so outsized in such a short time frame that your profits add up quickly.

That said, let's not forget that stocks are heavily shorted for a reason, so you have to use trading discipline and sound money management when playing earnings short-squeeze candidates. It's important that you don't go betting the farm on these plays and that you manage your risk accordingly. Sometimes the best play is to wait for the stock to break out following the report before you jump in to profit off a short squeeze. This way, you're letting the trend emerge after the market has digested all of the news.

Of course, sometimes the stock is going to be in such high demand that you risk missing a lot of the move by waiting. That's why it can be worth betting prior to the report -- but only if the stock is acting technically very bullish and you have a very strong conviction that it is going to rip higher. Just remember that even when you have that conviction and have done your due diligence, the stock can still get hammered if The Street doesn't like the numbers or guidance.

>>5 Stocks Under $10 Setting Up to Soar Higher

If you do decide to bet ahead of a quarter, then you might want to use options to limit your capital exposure. Heavily shorted stocks are usually the names that make the biggest post-earnings moves and have the most volatility. I personally prefer to wait until all the earnings-related news is out for a heavily shorted stock and then jump in and trade the prevailing trend.

With that in mind, here's a look at several stocks that could experience big short squeezes when they report earnings this week.

Bob Evans Farms